After writing a few pieces on Peloton I just had to switch to something really, really unhealthy. Actually in my past corporate life in a private equity fund I was occasionally trolled by colleagues for eating snacks that were too healthy in their opinion (hello WCP!). So maybe I decided to write about a cake company to address that trauma…

Seriously speaking, I stumbled upon Cake Box pretty much randomly. Getting hammered in the market for ~1.5 years in a row is not fun but at least it pushes you to think hard about what you may be doing wrong and how to adjust your approach to stock picking. A few months ago I had a conversation with a successful fellow private investor focusing on small and micro caps which ignited my interest to those smaller companies. Reading Peter Lynch’s “Beating The Street” (better late than never) fueled the excitement as Lynch also encourages private investors to look at places not too crowded with institutional investors. There is nothing new in the rationale for focusing on micro and small-caps itself: less analysts and investors are following these stocks, hence pricing is less efficient (at least in theory); in addition to that smaller companies may provide much longer runways compared to larger businesses. Of course these advantages come at a cost of lower transparency, higher likelihood of fraud, probably less professional management teams, you name it. I guess that investing in small caps also requires a specific set of skills which can be obtained only through experience, mostly painful. So maybe the usual initial excitement will soon fade and I will get back to more traditional stock universe, but I decided at least to give it a try.

Instead of sourcing ideas from other investors (which I often do as I believe there is nothing wrong with cloning per se) this time I decided to run a filter myself to get a better feel of the small/micro cap universe. Here are the parameters I used, based on a mix of recommendations from value investing disciples with some growth component added on top of them:

EV $50mn - $1bn

5-year revenue CAGR >15%

FCF positive

Net Debt/EBITDA <2x

P/E <20x and >0

Excluding energy and China (“too hard pile”)

TIKR screener returned around 100 names, mostly obscure like an Egyptian chemicals producer or an Australian manufacturer of metal detectors. Most of the identified companies seemed too cyclical or had pretty low margins which I try to avoid, especially in these times when high margin provides at least partial protection from inflation. Cake Box screened surprisingly well and upon having a closer look I couldn’t find an obvious reason to dismiss it. By the way, if you see something that makes Cake Box a bad idea, please let me know!

Business snapshot

Cake Box is a franchise chain selling fresh egg-free cream cakes with 230 locations across the UK. Launched in 2008 by two cousins Sukh Chamdal and Pardip Dass, it successfully survived the 2009 crisis, grew organically and went public in an IPO on AIM in 2018. While originally focusing on Asian areas in the UK and targeting vegetarians (cakes are egg-free) the company now appeals to a more diverse universe of cake lovers. Footprint as of September 2022:

196 franchise stores

33 franchise kiosks in ASDA supermarkets and shopping malls (a more compact and cost efficient auxiliary format)

3 distribution centers

1 storage facility

Franchise model

All Cake Box stores are operated by franchisees. Store economics look pretty favorable for franchisees: according to Cake Box, it costs around £160k to open a store, average EBITDA is £92k and payback period is 18-24 months. Attractiveness of Cake Box franchise is illustrated by repeat purchases: 46% of 92 franchisees operate more than 1 store. The company can afford to be selective as it accepts only 3 of 100 applications received per month.

Cake Box’ business model is simple: 85% of HQ revenues are generated by selling ingredients to franchisees. Obviously franchisees are obliged to procure everything from the HQ and to adhere to corporate standards which is ensured by a store check at least every 6 weeks.

The beauty of franchising model manifests in high ROICs north of 30% as most of capex is financed by franchisees.

Product

By offering egg-free cakes Cake Box has initially targeted vegetarians which I guess was related to religion since the first shops were located in Asian areas. Today the products are still egg-free (which arguably doesn’t affect the taste), but there is no focus on any specific audience. As for consumption patterns, Cake Box targets not day to day purchases but special occasions like birthdays. Sizes, styles and prices vary: from £3.5 pieces for 1-2 persons to £250 wedding cakes, but overall concept is value for money. An important part of value proposition seems to be the customization option: customers can have their photos printed on the cake if pre-ordered or can ask to write something with cream on the spot.

Customer reviews are quite favorable. I looked at a sample of 30 locations on Google maps which showed a 4.5 average rating. I couldn’t identify any recurring themes among complaining customers which is probably a positive sign: at least there are no obvious issues with the customer experience.

As a final touch to express product due diligence I asked my mother to visit a Cake Box store in Glasgow (she happened to be in Scotland at that time). Her experience mostly confirmed public reviews. The shop was neat and tidy, located in a relatively busy but not central area meaning lower rents. She tried a few basic £3.50 cakes which turned out to be of decent size and had a nice packaging, while the taste and freshness were fine too. Mum’s test: pass!

Presuming that the the audience likes the product per se, the key remaining product-related question is how demand will behave in a recession. My intuitive answer is that sweet products including cakes should be pretty resilient: people still want to indulge in something when times are tough and will probably look for something with the most bang for the buck. Will they choose these cakes instead of chocolate, candies, cookies or something else? It’s not clear at all, but unless UK falls into something similar to the Great Depression, I wouldn’t expect any significant changes in consumption mix in terms of product types. So if we believe that sugary products are more or less recession proof, Cake Box should probably do fine too.

I haven’t conducted deep research, but judging by what lies on the surface, consumption of sugary foods doesn’t fall much in crisis times, it may even increase:

“Chocolate, too, performed well during the Great Recession. For example, Euromonitor International researcher Andre Biciunaite found that German boxed chocolates grew 12% in 2009, apparently driven by demand for “instant indulgence” to relieve stress.”

“There is well-documented evidence going back to Freud, showing that in times of anxiety and uncertainty, when people need a boost, they turn to chocolate," says Garelli of the IMD. "That's why when the economy is bad, chocolate is still selling well.”

“Technomic released a study in October that found these after-dinner treats to be surprisingly recession proof. Only 1 percent of survey respondents did not eat dessert within that time frame, and 70 percent said they ordered dessert at least once a week. Dessert is unique because it not only involves sensory appeal, but also sparks strong emotional drivers," said Darren Tristano, Technomic executive vice president. “It can provide comfort when people are depressed and it can be used to celebrate and feel good about something.”

“The recession seems to have a sweet tooth. As unemployment has risen and 401(k)’s have shrunk, Americans, particularly adults, have been consuming growing volumes of candy, from Mary Janes and Tootsie Rolls to Gummy Bears and cheap chocolates, say candy makers, store owners and industry experts.”

Strategy

My impression based on Cake Box reports is that its strategy is not laid out well. Consolidating management’s statements from various sources implies the following targets:

Focusing on celebration activities rather than day to day purchases.

I guess it helps to have a narrow focus, but I’m not sure why adding some day to day items could hurt the company. A possible rationale for staying focused on celebrations that people are less price sensitive when it comes to buying a present.

Focusing on the UK market.

The management still sees growth opportunities in the UK and specifically named Scotland, Wales, North East and South West as potential new areas. Somewhat contradictory to that, “commencing a review on overseas opportunities” was one of CFO’s objective in FY 2022. If we look at UK map with Cake Box stores on it (see above), it appears that there is still room for growth indeed. Other things equal, I would prefer them to continue rolling out the time tested model in the UK rather than aiming for a long shot in another market.

Opening 250 stores.

The store target is surprisingly low and has not changed since IPO in 2018. I’m not sure why they haven’t yet raised it: maybe there is less room left in the UK market than may seem at first glance, maybe the management wants to avoid the risk of setting ambitious targets. None of the answers sounds good to me as an investor.

Bringing e-commerce share to 50%.

Share of online sales as of 1H FY 2023 was 21%, although yoy growth stalled after a covid boost. I’m not sure whether 50% is achievable and if yes, what the financial impact could be.

As for capital allocation strategy, there is more clarity than about the general strategy:

Paying the shareholders back.

Some cash can be returned to shareholders in the form of dividends and buybacks (historically they have never done buybacks, but paid dividends consistently). I think they are even too conservative in terms of cash reserves.

Small acquisitions are possible.

It’s not clear whether the management was talking about buying a company or some fixed assets like a warehouse or a production facility.

Focusing or organic growth instead of M&As

I guess organic growth makes sense for a franchise network because if they bought some stores they would need to rebrand. In addition to that, organic growth is almost free for the franchisor as capex is financed by franchisees, only minor incremental costs of managing a larger franchise network arise.

Management

CEO

Cake Box is still led by Sukh Chamdal who co-founded the company in 2008. He is an industry veteran with more than 35 years of experience in food manufacturing and retail. Sukh worked in a family business selling Indian sweets and savories, owned a food catering company and worked as a consultant for a food equipment company. Most importantly he still owns 25% of the company.

CFO

Until recently the financial function was led by the second co-founder Pardip Dass. The reason for him stepping down in March 2022 is not clear, some linked it to accounting issues that were uncovered in 2021 (more on this in “Potential red flags” section). It appears that the transition was not prepared in advance: Cake Box appointed an interim CFO in March 2022, he left the company in November and the financial function is now managed by the Chairman of the Audit Committee, a non-executive Board Member. This will continue until April 2023 when Michael Botha, the new CFO is expected to join the company. Michael is currently working his notice with his current employer, one of the largest franchisees of Domino Pizza in the UK where he spent 12 years.

COO

Cake Box appointed Richard Zivkovich as the new Chief Operating Officer in June 2022. Richard has around 15 years of experience in operational roles in fast food and restaurant chains. Former COO Jaswir Singh who worked at Cake Box since 2010 was transferred to a new Chief Commercial Officer role.

In 2022 Cake Box also hired a Marketing Director, an IT Director, a Customer Service Manager and a Learning & Development manager, so it appears that the company recognized the need to upgrade and expand its top management team.

A potentially worrisome signal is Cake Box’ employer rating as measured by Glassdoor reviews: it’s just 2.9 out of 5. However, the vast majority of negative reviews are submitted by store employees. Complaints refer to long hours, disrespectful treatment by managers and so on. However, I don’t think that this is something unique for a low paying, physically demanding unskilled job. Even fast food majors which presumably have more polished business processes and better benefits do not score well on Glassdoor reviews: McDonalds 3.5, Burger King 3.4, Wendy’s 3.3. So, while it would be nice if Cake Box had a better rating, I don’t think that this is a red flag.

Ownership structure

Cake Box has a surprisingly high institutional ownership for the company of its size: 53% shares are owned by institutions. Probably not an ideal set up for a micro cap: common knowledge is that it is better to find stocks that institutions are less familiar with so that the stock may rerate when institutions pile in.

Management and their families own 37%, of which 25% belong to CEO/co-founder. Despite CEO selling a large chunk of his stake (7.5% of total shares outstanding) in 2021, he still has skin in the game.

Notably Amati Global, one of the two largest institutional shareholders, decreased its stake from 9.7% to 4.7% as reported in November 2022. As usual, we can come up with lots of reasons for selling starting from company specific issues to the fund dialing back on risk, but other things equal I would not call this a good sign.

Financial metrics

Comparison of revenue growth with LfL sales growth implies that most of revenue expansion was driven by new store openings. I think there is nothing wrong with this for a franchise business because the vast majority of capex is financed by franchisees which means that the company’s growth engine is capital light.

As for LfL sales, there was an impressive spike in FY 2021-2022, but LfL calculations for these periods are somewhat messy so I wouldn’t rely on them too much (more on this in the next section). In addition to that, LfL sales went negative in 1H FY 2023 (April-September 2022) at -1.1% despite UK retail price index being close to 12%. On the bright side, LfL got better in September (+3.6%) and October (+4.6%) but it was still way below UK retail inflation and food inflation (14% and 16% in October respectively).

Gross margins are healthy and have been on the rise which is something that I would expect from a franchising model: operating leverage should become visible as some of production costs are fixed and the store count keeps growing. It may well be that Cake Box was overearning during covid, so going forward gross margins could settle down somewhere around 45%.

Operating and net income margins dynamics are not so rosy. Downward pressure was driven mainly by SG&A expanding as a percentage of revenue - exactly the opposite of what I would expect to see in an expanding franchise chain. Either they initially underinvested in SG&A in earlier years and had to catch up later (recent upgrades of top management team support this theory) or their operations are just inefficient. The picture gets even more gloomy if we look at 1H FY 2023 results: operating margins collapsed to 12% and net income margin to 9%, although in this case the management clearly stated that some of the costs were one-offs related to upgrades of production facilities.

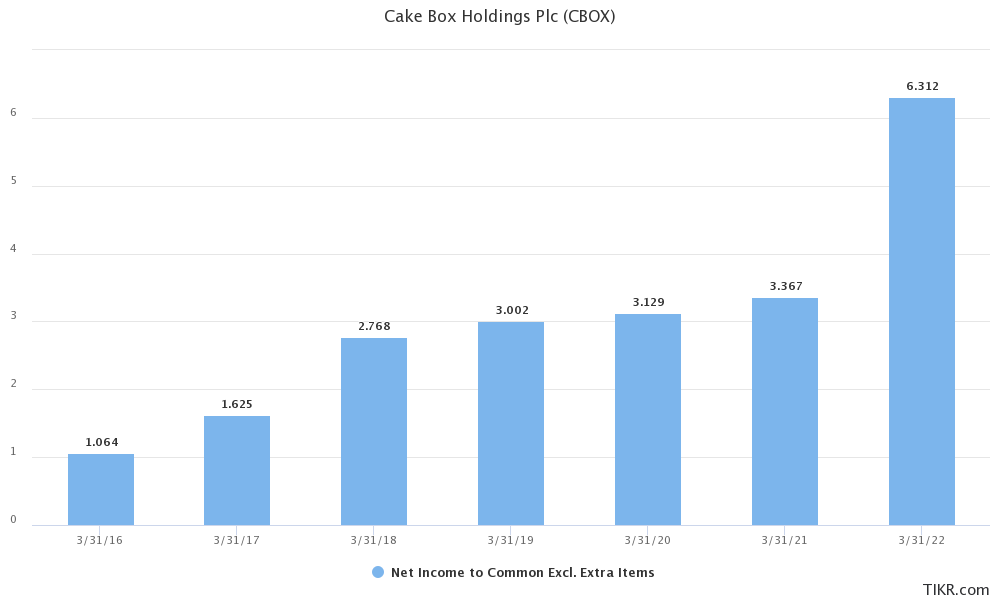

Net income growth in FY 2018-2021 has been subdued at just 7% due to SG&A pressure described above. FY 2022 earnings are an outlier, mostly due to one-off non-cash gains.

Cash flow from operations and free cash flow have been mostly growing while capex remained fairly limited with an exception of FY 2019 when they invested in two production and distribution centers.

ROCE is the company’s bright spot thanks to the franchising model. Cake Box has been able to transfer most of capital costs to its franchisees and I think it is reasonable to expect high ROCE in the future as long as operating margin does not collapse.

When it comes to cash management and leverage Cake Box looks rather conservative which definitely helps as we enter a period of higher interest rates. The company has been steadily accumulating cash, while keeping debt at very reasonable levels and consistently paying dividends (the average dividend payout ratio was 40% during the last 5 years). One may even argue that management has been too conservative and could have spent some excess cash on extra dividends or buybacks.

All in all, the financial picture looks healthy in most aspects: revenue growth, margins, return on capital and leverage.

Valuation

For almost two years after its IPO in 2018 the stock was trading in a relatively narrow range. While revenues and profits kept growing at a decent pace (mostly driven by store openings), multiples were compressing. In March 2020 the stock fell 65% but quickly rebounded and rose 3.5x from lockdown trough to 2021 peak. Covid didn’t hurt the business in any meaningful manner and even boosted online sales, but most of valuation increase was driven by multiple expansion. Multiples ended in an unreasonable territory (similar to many other growth stories): P/E reached 45x while EV/EBITDA went as high as 30x. This was followed by an inevitable cooldown and valuation compression was likely supported by insider selling: CEO/co-founder sold almost £15mn worth of stock (7.5% of shares outstanding) in November 2021 near the high and former CFO/co-founder sold another 3.75% of shares outstanding in July 2022 as he was departing the company.

As of December 2022 the stock trades at a relatively humble 7.4x FY 2022A P/E and 9.6x LTM P/E (while LTM arguably contains significant one-offs). The key question is where the earnings head from this point.

Rather then betting on a single path I prefer to look at a few scenarios, let’s call them “base”, “disaster” and “optimistic”. Over the last 5 years Cake Box has been adding 24 stores per year on average with relatively low variance (min. 20 stores in FY 2020, max 28 stores in FY 2022). This includes only standard stores, not kiosks as it’s hard to tell whether the new format will work in the longer term, so I ignore this potential growth driver for the sake of conservatism. I assume 25 new stores per month (in line with history) in the base case, 35 in the optimistic case and zero in the disaster scenario. A recession can actually have opposite effects on new store openings. The obvious one is that general economic activity heads lower and this includes small franchise businesses. At the same time, as some people lose their jobs they may go for a franchise store as an alternative to corporate employment: according to Cake Box, such behavior was observed during lockdowns. But my guess is that negatives effects of a recession will prevail.

Like-for-like growth averaged 9% p.a. over the last 5 years but was pretty volatile: from 2% in FY 2020 to 15% in FY 2021. The last LfL reading (April-September 2022) is even negative at -1.1%, although LfL went back to +4-5% in September-October 2022. I believe that returning close to historical growth is an optimistic scenario, the base case is half of it (5%) and a disaster can imply negative LfL of -5%.

Gross Margin is one of the core drivers of the bottom line, but it is also pretty hard to forecast in this case. Historically there was a clear growth trend, mostly likely driven by economies of scale. It would be a stretch to assume that margin expansion continues, so I expect 45% for the base case (close to historical average), 40% for the disaster case (slightly below the worst year) and 48% for the optimistic one (still below covid high). Probably the only thing we can be sure about at this point is that Cake Box will experience pressure on margins as customers may not be willing to accept higher prices while input costs are on the rise: UK food (ex-alcohol) inflation hit 16.4% in October 2022.

SG&A is mostly comprised of employee expenses, hence it is reasonable to expect inflationary pressure in this line too, especially given the company’s recent hiring of senior managers as they strive to “professionalize the team”. Historical pattern of SG&A as a percentage of revenue is somewhat counterintuitive: I would expect a declining percentage as the company scales, but it was increasing. The good news is that the company survived with just 15% SG&A/Revenue ratio in FY 2017-2018 when revenue was 60-75% lower than in FY 2022. My reading is that there is room for cost optimization and we may see SG&A share declining again. However, given inflationary headwinds I assume 25% in the base case, 30% in the disaster case and 21% in the optimistic case.

Although I tried to avoid extreme assumptions, bottom line is highly variable between scenarios. Net Income is £1.2mn in the disaster case, £7.0mn in the base case and £11.8mn in the optimistic case. P/E multiple apparently should also be correlated with the scenario: lack of growth and depressed margins may call for P/E multiple close to the current level, base case deserves a P/E of at least 10x in my opinion, while in optimistic case we may well see 15x or higher depending on growth rate and overall market dynamics.

Obviously applying different multiples for different scenarios results in even higher variance of target share price. The downside in the disaster case looks disastrous indeed at -80%. Of course, everything depends on probabilities that we assign to each case. I will leave this up to the reader, but my gut feel is that the upside in the base case scenario is not enough to compensate the downside of the disaster case, while chances for the optimistic case are too slim.

Potential red flags

With a caveat that I’m a complete newbie in micro/small-cap investing, I guess a micro cap without potential red flags is a rare beast. The question is whether any of those red flags are critical. In Cake Box’s case a few facts caught my attention:

Concerns about governance, finance and reporting processes.

“The Board recognises and remains cognisant of the concerns previously raised by some shareholders around the Group’s internal governance, finance and audit processes, and continues to work to evolve, improve and further professionalise the Group … In January 2022 we were made aware of several inconsistencies in the reporting of prior year numbers in the last Annual Report. Whilst none of these impacted the current year figures that had been reported on and had no bearing on the financial performance of the Group it was regrettable that this happened. We corrected these transposition errors and updated the 2021 Annual Report, which can be found on our website. The conclusion from our review was that the time between signing the reports and having to print and post the Annual Report to shareholders to meet the planned AGM date was too short to allow an accurate checking of the prior year figures. As a result, this year we have moved the AGM date back a few weeks to ensure there is sufficient time to carry out a proper check.”

The good part is that the accounting issues seem to be immaterial, the Board acknowledged them and took steps to fix them, including engagement of BDO as an in-house auditor.

But here is a more concerning fact: the auditors who served Cake Box since IPO in 2018 resigned in 2021 with the following comments:

“During the course of the audit engagement, we became concerned about the robustness of the Company’s control and governance frameworks due to delays in the provision to us of audit evidence, which was not provided on a timely basis. Such delays did not, however, prevent us from issuing an unqualified audit opinion on the Company’s financial statements for the year ended 31 March 2021.”

Given this wording, can we still rely on the company’s accounts? Is such a statement a strong signal that the company could be cooking the books?

Update: a few days after finishing this note I discovered a great report by Maynard Paton (https://knowledge.sharescope.co.uk/2022/01/21/cake-box-holdings-cbox/) who uncovered lots of issues in Cake Box accounts. I encourage you to read it if you are considering to invest in Cake Box.

Unclear rationale for insider selling.

CEO explained the reason for selling some shares in 2020 by his desire to “share a slice of the cake”:

“I had no intention of selling down, but the intense pressure from all the investors to increase the liquidity of the shares. And we did have a lot of pressure from the smaller investors who wanted to buy, but there was nothing available across the big institution. And so I reluctantly slowed down a little bit more to allow liquidity, and it has increased liquidity and allowed everybody to own a slice of the cake, if I can say so.” - Sukh Chamdal

Pardip Dass, the second co-founder sold all of his shares in 2022 after stepping down and passed some of the remaining ones to his ex-wife. As the first part of the adage goes, there may be numerous reasons for managers selling their stocks. In this case it is not clear whether the sale was driven by a corporate conflict, a desire to enjoy his pension or something else. Other things equal I would prefer to have both co-founders on board.

Messy LfL calculations.

When calculating like-for-like sales in FY 2020-2022 the company used different periods to adjust for covid impact, thus making it hard to determine the true like-for-likes. The logic is there: Cake Box stores were closed for several weeks in spring 2020 which distorts year-on-year comparisons. At the same time I feel that there is some lack of transparency, maybe even intentional choice of periods that make like-for-likes look better.

CEO is 60 and there is no succession plan.

I certainly respect the founders who built a business from scratch and kept developing it for a long time (15 years for Cake Box). At the same time I believe that in most cases when the founder and CEO is 60, it’s better to have at least a decent bench if not a specific potential successor within the company or at least to prepare a succession plan. I have not seen anything of the above when researching Cake Box which is somewhat worrisome. Does the CEO still have enough motivation and energy? What happens if he leaves for whatever reason?

Conclusion

Pros

A time-tested product in a category that is likely to suffer less than others in a recession

Asset-light franchise model generating high ROICs

Ample room for growth even within the UK judging by current penetration and lack of direct competitors apart from mom-and-pop shops

Alignment of interests: CEO has a 25%+ stake in the company

Conservative debt policy with a consistent net cash position

Reasonable valuation: P/E 7.4x / 9.6x, EV/FCF 10.6x / 12.3x for FY 2022A and LTM accordingly

Cons

Unclear effect of a recession on revenue growth and margins with weak April-September 2022 results adding to my worries

No clear growth strategy

Increasing SG&A as a percentage of sales despite the company scaling

Accounting issues that could be a consequence of a subpar finance function or window-dressing/fraud

CEO approaching retirement age without signs of succession planning

As indicated earlier I’m a complete newbie in micro- and small-caps, so one should take this analysis with a grain of salt. I’m also pretty sure that anyone with more experience in the space can poke holes in my analysis and I encourage you to do this (please feel free to reach out, I’m always happy to discuss). With this caveat in mind I believe that Cake Box could be a nice risk/reward opportunity, maybe at a slightly lower valuation. An extra boost to returns may come from the currency: if you assume that UK is not a complete train wreck, GBP may regain ground from the current depressed level.

As for me, I’m inclined to start building a position in Cake Box, but for now I’m sitting on the fence as I continue watching the UK macro situation and pondering whether Cake Box is cheap enough to compensate for the risks.

Nice write up with a lot of great information!! The red flags are valid points, I am thinking 1,2 and 3 are more temporary because the company is new in the market.

My thesis: unique product for specific group of people without any big competitors, high ROIC due to light asset business mode.

Their product is mainly targeted for vegetation, which is about 1-2M 2% of UK population. I am not aware big competitors are targeting this segment. The products are high quality with good reviews.

If the demand (consumer does not leave and their taste is not change) is there, the business will go back to normal after macro recession.

Based on that: my downside case is a little different from yours. I would give 30M revenue + 15% operating margin , since the main item (Wages and Salaries) of expense is flexible cost, manager team could optimize it based on the condition.

By the way: I am also newbie and willing to know more.