Charlie Munger's Q&A session

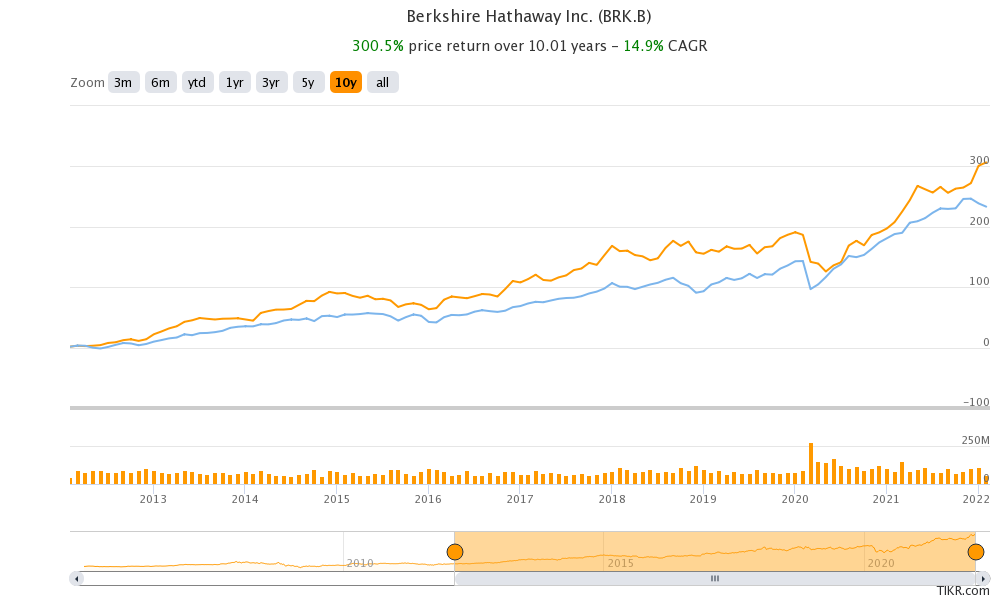

Some commentators claim that Munger and Buffett have lost their touch, missed the tech train, keep hanging on to outdated beliefs, etc. Judging by Berkshire’s performance, I would say it’s a bit too early to write off the old guard: in the last 10 years Berkshire’s stock delivered 14.9% annual returns vs 12.6% for S&P 500. I have a feeling that if we finally face a real meltdown after 12 years of “stonks only going up”, the relative performance gap may even widen. In any case, even though I don’t agree with some of their theses (e.g. complete denial of crypto), when Buffet or Munger speak I prefer to listen. Below are my key takeaways from Charlie Munger’s Q&A session held at The Daily Journal’s shareholders meeting in February 2022.

Rates and inflation

We are in terra incognita in terms of money printing scale which may lead to terrible trouble

Japan may serve as a historical example of large scale money printing: it did not lead to inflation, but living standards were stale for 25 years (probably mostly driven by increased competition from China and Korea rather than money printing). The Japanese society remained stable, but there are cultural and demographic peculiarities (Japan’s population is older and monoethnic), so the outcome in the US may be different

Latin American countries that print too much money often end up with a dictatorship. Resembles Plato describing evolution of Greek city-state democracies: started with “true democracy” (one vote per person) followed by demagogues and people becoming too relaxed which then leads to tyranny

Paul Volcker’s methods (increasing rates to 20%) worked against the 1970s inflation, but also led to a harsh recession. Modern politicians may not allow this kind of response from the Fed

It’s very seductive for the government to keep rates low and keep printing money to cover their debts

Labor market

Many people will never return to 5 days a week in the office

Berkshire has been successfully working remotely for a very long time: face to face meetings twice a year, everything else done over the phone/e-mail

Remote work makes life simpler, cheaper and more efficient

The government has overshot with stimulus. Capitalism works as follows: if you are an able bodied young person and refuse to work, you suffer a fair amount of agony. If you break this principle and let people stay home not working and not experiencing difficulties as a result, it disrupts the system

US politics

Radicalization of views continues which does not help the stability of the system

Introduction of a third party might be a solution

A phrase attributed to Benjamin Franklin “when the citizens of the Republic learned they can vote themselves money, the end of the Republic is near”. The Republic is probably closer to the end now than it was 200 years ago

Market conditions

Examples of “wretched excesses”: GameStop short squeeze, Bitcoin, VC and some parts of Private Equity throwing too much money too fast

Stock market has become similar to gambling. Maybe it should be regulated, e.g. by taxing short term gains and making the stock market less liquid

Excesses of 1920s gave us the Great Depression and the Great Depression gave us Hitler [I’m not sure that I follow Munger’s logic here, but I don’t have enough knowledge of history to judge]

US tech regulation: it’s good to have large national champions, don’t want the Internet to be dominated by foreign companies

The Daily Journal used up its cash for investing, but Berkshire still keeps a lot of cash; not because it is trying to time the market but because it cannot find attractive investing opportunities. Asset are elevated because a lot of buying is incentivized by fees (e.g. private equity firms inflating their AuMs to increase fees)

Munger family’s portfolio:

Berkshire

Costco (not buying at current elevated price, but not selling either; still believes it is a good long term investment)

The Daily Journal

Chinese stocks

Apartment houses

China

Invested in China because Chinese companies provide a better combination of valuation and business strength vs competition compared to the US

Alibaba’s VIE structure poses a risk of ownership as you own a derivative, but the risk is unlikely to play out as long as “there is a reasonable honor among civilized nations”

Wishes that the US allies with China instead of confronting it. US people should realize that the Western governance system does not suit all nations

Buffett is less comfortable with China than Munger [Although Berkshire invested in BYD, a Chinese auto manufacturer]

Deng Xiaoping is one of the greatest leaders in history because he gave up his own ideology to try something else that worked better, bringing the nation out of poverty into prosperity in 30 years

Crypto

Proud that he didn’t invest in crypto even though it has become a $2tn asset class

Crypto is like a venereal disease. Used for criminal activity, thrives on envy (everyone can create his own currency which is crazy)

Crypto should be banned, China was right to do it

It’s OK for the Federal Reserve to have their own cryptocurrency. Essentially we already have digital currency - it’s the banking system

Renewable energy and hydrocarbons

Solar and wind energy has become pretty efficient and competitive

It’s better to save US hydrocarbons for future use rather then depleting them. Hydrocarbons are useful not only as fuel, but also for chemical uses, e.g. fertilizers, and will remain an important resource

Global warming is not as bad as some people claim

Gaming

Bobby Kotick [Activision Blizzard’s CEO] is one the smartest executives

Gaming is here to stay

Doesn’t like addicted young males spending 40 hours a week playing, but this refers to anything that is so addictive, not just gaming

The world in general

Most of the human civilization’s advances affecting day to day lives took place in the last 100 years

Despite dramatic improvement of living standards (e.g. the main problem of poor people in the US is that they are fat rather than lacking food), people are less happy with the current state of affairs than they were when life was harder

The world is not driven by greed, it is driven by envy. People take for granted that they are 5x better off than they used to be, they focus on someone else having more and think it is unfair

Secret to a happy life - have realistic, i.e. low expectations. Take life’s results, good and bad with a certain amount of stoicism. Seek out and get as many good people into your life as possible and keep the rest the hell out

Investing in general

It’s OK to have some potential investments that you just don’t want to bother with

Ben Graham school’s principles will never die because getting more value than you pay for is the essence of investing

If you are trying to beat the average, you don’t need diversification. You are lucky if you can find 4 decent assets to buy. Finding 20 is nearly impossible

Technological change can destroy many businesses that are very strong now and it’s very hard to predict in advance which ones will survive and thrive

Giving a lot of voting power to passive index funds as the popularity of passive investing keeps increasing may not end well

Cost-cutting/zero-based budgeting (approach popularized by 3G Capital) often works well in large companies as they tend to have a lot of excesses, but you need to stop at some point not to cut too much (maybe you should even target less than 100% efficiency)

Learn to swim as well as you can against the tide, don’t try to predict the tide. I.e. focus on finding good businesses instead of trying to time the markets

If you are going to invest in stocks for the long-term, or real estate, there are going to be periods when there's a lot of agony and in other periods when there's a boom. You just have to learn to live through them

Getting and staying rich will be much harder for the current generation than it was for Charlie’s generation