Making sense of Peloton's Q2 results and restructuring plan

My relationship with Peloton is somewhat complicated. First of all, I am not a fan neither of cycling (especially indoor cycling), nor of running, and I have never tried Peloton’s machines. However, I am a big believer in companies that keep delighting their customers. My hypothesis is that customers’ love tends to translate into financial performance sooner or later. So I was obviously charmed by Peloton’s 90%+ annual customer retention and 90+ NPS (yes, it is an in-house metric that theoretically can be manipulated, but retention is much harder to manipulate at least in the longer term). So I decided to go with the flow and bought the stock at $66 in summer 2020 and sold it at $125 just 4 months later as valuation became too aggressive in my opinion. I kept watching the business and the stock during 2021 considering to jump in again as it gets sold off on the back of reopening and growth stock multiples cooling off.

A drop from $170 to $100 looked good enough as the business kept growing and most importantly churn remained low, so I averaged in at $100. Even the dismal results of Q4 FY 2021 (ending June 2021) did not put me off despite a huge drop of Gross margin, rise of operational expenses and a spike in cash burn as the company kept spending money like a drunken sailor. Not sure what exactly led to the next smart decision on my side, maybe it was some sort of anchoring or overconfidence bias, but in any case I concluded that the post-market 25% drop after even worse Q1 FY 2021 results was an overreaction and added more at $65… Then came the notorious $1bn equity raise at $46 after the “we don’t need a capital raise” statement from the CFO two weeks earlier. So here I am now, bagholding the former FinTwit darling with an average cost of $88, musing on the company’s prospects and valuation.

Q2 FY 2022 (ending in December 2021) results were accompanied by a lot of material news: Founder/CEO stepdown and management reshuffle, rumors about potential acquisition by Apple, Amazon, Nike, etc (basically everyone and their mother), cancellation of Peloton’s greenfield production facility in the US and so on. Firstly, let’s see what is going on with the business.

Operating metrics

Growth of Connected Fitness subscribers (users of Peloton Bike or Thread paying $39 per month) is not that bad at first glance given the reopening that took place in FY 2022 and hard comps of FY 2021. However, growth was also positively affected by hardware discounts (a very questionable move as some argue that Peloton should pursue an Apple-like approach with premium pricing rather than trying to expand its TAM by lowering prices) and enormous sales & marketing expense ($350mn, 2x yoy). But since we observe only the net effect of significant negative and positive factors I guess it is tricky to decipher the gross effect of each.

Digital subscribers (those who do not own the equipment but pay $13 per month for Peloton app) growth decelerated even faster than Connected Fitness subscribers. This could be due to accessibility of digital apps. I guess many users were ready to spend $13 per month on a digital app during the lockdown period (a much easier decision than committing $1,500+ on a bike or $3,000+ on a treadmill). But it is not sticky enough so they are easily giving it up once they can go back to the gym. In any case digital subscription is unlikely to become a meaningful revenue and profit generator for Peloton, but it is an important marketing instrument as the company converts digital subscribers to Connected Fitness subscribers. Hence, digital subscriptions can probably be considered a leading indicator for hardware purchases.

User engagement was an important part of my original bullish thesis, so its fall close to pre-pandemic levels is definitely concerning, although probably not surprising as people spend more time outside and in the gyms. Peloton also noted that they are seeing an unusually high sequential growth of engagement in January vs December (historically January is the best month for Peloton as New Year resolutions are still fresh). 15 workouts per month still sounds like a lot, but we should keep in mind the calculation methodology: these are workouts per connected device which can be used by multiple household members and even a 10 min exercise counts as a full workout. All in all I think the dynamics are not that bad given that people are likely tired of being locked down and maybe go exercising outside and in the gyms even more often than they did before the pandemic.

Monthly customer churn is a rare bright spot in the quarterly results. Somehow Peloton still manages to keep the Connected fitness user base extremely sticky: 0.79% monthly churn implies that 91% of subscribers stay with Peloton after 1 year. I would expect at least a temporary spike in churn as some users give up their hardware as a forced pandemic time solution, but so far we do not see any signs of this. Some critics point that churn may be optically low due to: 1) hypergrowth of the user base that means a high share of fresh users who have not yet gotten bored; 2) an option to pause the membership for 3 months free of charge (users that have paused are not included in churn). Monthly churn is one of the key metrics that I would be observing in the coming quarters, but so far it looks solid.

Financial metrics

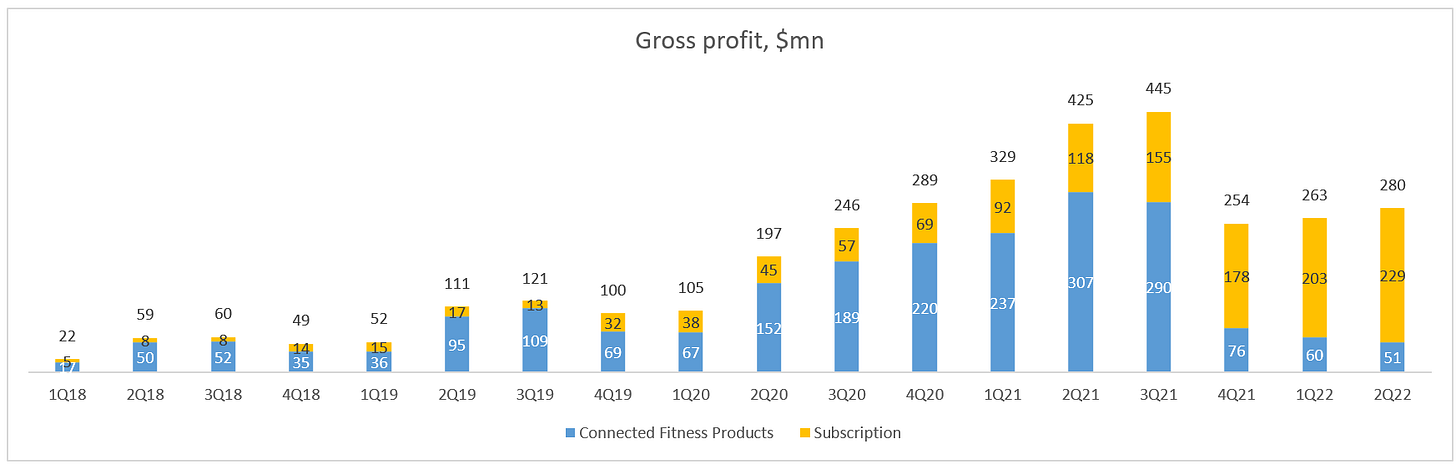

Revenue growth in the last two quarters has fallen dramatically as Peloton reduced prices on its hardware but this was not compensated by a corresponding rise in unit sales, notwithstanding enormous marketing spend ($350mn in Q2 and $284mn in Q1). Hardware revenues even decreased -8% yoy under pressure from price reduction ($1,895→$1,495 for the original Bike, a 21% drop). Subscription revenue did not decelerate that dramatically and still posted a 73% yoy growth, an enviable level for most SaaS businesses, as churn remained low and hardware install base kept expanding.

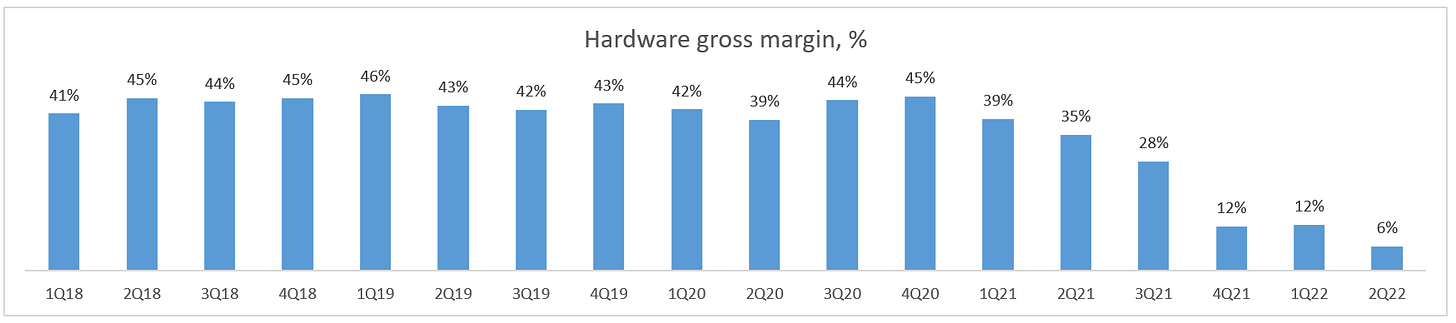

Probably one of the main pain points for Peloton at the moment is the collapsing hardware gross margin. Having started more than a year ago, the decline has brought hardware gross margin to meagre 6% as a result of price reductions and cost inflation. Back in 2020 the company boasted gross margins that more than compensated S&M expenses leading to negative customer acquisition costs. Now even the direct costs of sale are barely covered and I don’t think that this is sustainable. Something has to give: the company should increase hardware or subscription prices, reduce direct costs for hardware and/or make sales & marketing more efficient. According to the recent restructuring plan, Peloton targets to “trend closer to net CAC neutrality in the next several quarters” .

Subscription margins remain healthy at 68% as of Q2 and keep gradually improving as economies of scale (mainly content expenses) are kicking in. Subscription contribution margin (i.e. margin including only variable costs of subscription business) is even slightly higher at 71.4%.

The cost side of the business looks like a complete mess. We do not know what exactly the management’s plan was, but an obvious guess is that they assumed covid had just ignited Peloton’s hypergrowth and they should spend aggressively to continue riding that wave. In hindsight this was a poor decision as most of the 2020-21 growth seems to have been driven purely by lockdowns and the company failed to find ways of materially expanding its user base (apparently doubling S&M spend and offering discounts on hardware did not really help). Most importantly, it looks like the management was not agile enough to acknowledge the changing reality and adjust course promptly.

The good thing is that Peloton has finally accepted the fact of overspending and is now committing to $800mn annualized cost reduction (consisting of $500mn operational expenses and $300mn COGS) which includes cutting 30% of its staff. As 2,800 employees are getting laid off, in addition to the usual cash compensation they will receive a complementary 12-month Peloton membership - what an irony! Some people find it unfair that the layoffs will not affect the instructors who are making $500k+ per year. I disagree: the company is right to keep them because Peloton’s celebrity-like instructors are the cornerstone of customer engagement and stickiness.

Interestingly, Peloton has also ramped up their R&D expenses and spent ~$100mn per quarter during the last 3 quarters. So far new product announcements have not been impressive: instead of a widely anticipated rower they introduced Guide, a $495 device for strength training (launching in April 2022) and a $90 heart rate band (launched in February 2022). Guide is simply a camera which monitors your movements and is supposed to provide guidance on how to exercise properly. Interest towards Peloton Guide as measured by email subscriptions for product news is below the company’s expectations (this is based on allegedly leaked internal materials, so not necessarily accurate). The heart rate monitor also does not sound like a game changing product as its functionality is pretty basic: it just measures the heart rate and indicates the current HR zone with color lights.

I would give the company benefit of doubt and some time to see the end results of those R&D expenses. Obviously the dollars spent cannot be converted into new exciting products overnight and historically Peloton’s hardware has been really good according to customer reviews.

Cash burn has become disastrous in the last 3 quarters and did not improve much in Q2. The company had remained loss-making and had aggressively invested into inventory expecting a booming holiday season which did not materialize. Peloton also went full throttle on capex spending as it acquired a gym equipment manufacturer Precor and planned to build a brand new manufacturing facility in Ohio. The latter has now been cancelled (probably a reasonable move in the current environment) but the company has already spent $30mn on it and plans to spend another $60mn before reselling it at a loss.

The controversial $1bn equity raise in November 2021 helped to stabilize the situation leaving the company with $1.6bn of cash as of 31.12.2021. Debt level is also manageable with $0.8bn of convertible notes due in 2026, $0.8bn of leasing obligations and $0.5bn of undrawn credit facility. Fun fact: convertibles were issued in February 2021 at 0% interest rate and $240 conversion price (8x higher than the current price) - my condolences to those who bought them and kudos to Peloton management for perfect timing. Provided that the new management’s cost cutting initiatives bear fruit without suppressing revenues, the company should be able to survive without additional capital raises.

Guidance

Guidance for both Q3 and FY 2022 is subdued as one may expect. The company forecasts just 2.93mn Connected Fitness subscribers by the end of next quarter and 3.0mn by the end of FY 2022 (June 2022) which implies net additions of only 160k in Q3 and 70k in Q2. We should also keep in mind that even with an impressively high annual retention of ~90% the company is still losing ~75k subscribers per quarter at the current scale, so some investments in sales & marketing are required just to keep the status quo.

Hardware gross margin seems to have bottomed as the company guides for 15% in Q4 FY 2022 and commits to further margin improvement. Subscription margins are still slightly increasing and gravitate towards 70% which looks very healthy. Maybe the ex-Spotify and ex-Netflix guy (more on him below) can find ways to further improve the subscription margins.

Management reshuffle

Although some have already been calling for it (including activist investors), I guess that such a prompt announcement of departure by John Foley, Peloton’s co-founder and CEO, came as a surprise to most, including myself. While he deserved credit for building Peloton from scratch to an indisputable category leader with cult-like following, Foley has also taken a number of controversial steps. Poorly handling the deadly accident with Peloton treadmill that led to product recalls, uncontrollable growth of expenses, boasting that “we are playing chess where others aren't even playing checkers” before delivering disastrous results, selling tens of millions worth of Peloton stock at $100+ per share and buying a nice $50mn house, hosting a posh party with some Peloton instructors amid covid restrictions as corporate events officially got cancelled, putting his wife in charge of Peloton apparel business, you name it. In any case I believe that he deserves respect for what he has built so far and for having courage to step down now. As Foley put it:

Our goal has always been to bring immersive and challenging workouts into people's lives in a more accessible, affordable and efficient way. We've done a great job of delivering on that vision, and our large and loyal member community is proof of that. But we also acknowledge that we have made missteps along the way. To meet market demand, we scaled our operations too rapidly, and we overinvested in certain areas of our business. We own this. I own this, and we are holding ourselves accountable.

The new CEO Barry McCarthy is bringing valuable experience in subscription businesses having spent 5 years in Spotify (CFO and head of advertising) and 10 years in Netflix (CFO). Another interesting twist is that he has been an Executive Advisor at TCV since 2011. TCV was one of the first major investment funds that supported Peloton and notably participated in the latest capital raise pouring another $100mn into the company at $46 per share. So it is likely that TCV as one of core shareholders is fully aligned with the new CEO.

I don’t have an educated view on McCarthy’s chances for success. Obviously bringing an outside CEO to substitute the founder is always a risk. Some investors are quite enthusiastic about his abilities, while also acknowledging the difficulty of his task:

Barry’s first letter to all Peloton employees has already leaked (oh boy how bad is Peloton at maintaining confidentiality!) and so far I like what I see, at least in terms of culture and values. It looks like he is planning to build a culture similar to Netflix and Spotify which are good examples in my opinion. At the same time he states that John Foley will remain his partner and will be actively engaged supporting Barry with his “visionary powers”. A few excerpts from the letter:

Management reshuffling does not end with CEO replacement. The list of top managers shown the door includes William Lynch (ex-President, now non-executive BoD member), VP Commercial (ex-CEO of Precor that was acquired by Peloton), head of apparel (Foley’s wife). My feeling is that the current CFO will also be replaced soon enough as her “no need for capital” statement just two weeks before the equity raise was a complete disaster; I think this qualifies as outright lies and contradicts Barry’s commitment to transparency.

All in all my opinion is that these painful changes have long been due and even though such an abrupt change in management is somewhat unexpected and may seem risky, leaving things as is would be even riskier.

Restructuring plan

The company outlined the following priorities:

Reestablish Peloton as a sustainable growth company

Restore Connected Fitness hardware margins

Generate consistent positive free cash flow to self-fund the business

In terms of practical steps, they are planning to:

Cut $500mn of operational expenses: employees, marketing, real estate, software, outsourced services (did McKinsey suggest to cut spending on McKinsey?!)

Cut $300mn of COGS, mainly in procurement, manufacturing and logistics. Savings on logistics are low hanging fruit (e.g. switching from 60% in-house to 40% in-house), while procurement and manufacturing is expected to take more time. The total $800mn of opex+COGS savings are expected to fully kick in in FY 2024

Reduce capex from $600mn to $350mn in FY 2022 and “work towards a capex-light business model going forward”. Capex reduction includes cancellation of a greenfield production facility. They will still spend $90-100mn to complete the building before reselling the land and building "to recover the majority of the spend”

Reduce inventories (they have already slowed down production)

My take is that all of the initiatives make total sense. I struggle to understand why they have not started doing any of these things earlier, but it is what it is. Now execution is key.

Valuation

Finally, the million dollar question: does it make sense to invest in Peloton at the current price? We seem to be at a pivot point with lots of questions and few definitive answers. How will people behave after pandemic measures are removed? How successful will the treadmill and new products be? Will Peloton’s US playbook work in international markets? How large is Peloton’s addressable market? Where will unit economics settle? Can the new management team execute better than the previous one?

There is also a potential acquisition wildcard. I think acquiring Peloton could make sense for many giants including Apple, Amazon, Netflix and Nike. My bet is that connected fitness is here to stay and Peloton is an unquestionable category leader, so why not buy instead of building. The key question is probably valuation: I doubt that Peloton’s shareholders including TCV would be willing to sell for less than $46 (price of the latest equity raise) plus some premium, which brings us to something like $15bn+ for 100% of the company, a sizeable check even for the big guys. It is also not clear what Foley’s stance towards the sale is, while his consent is required for the deal to go through. Taken together, I would view M&A as an option but I wouldn’t be assigning a high probability to it.

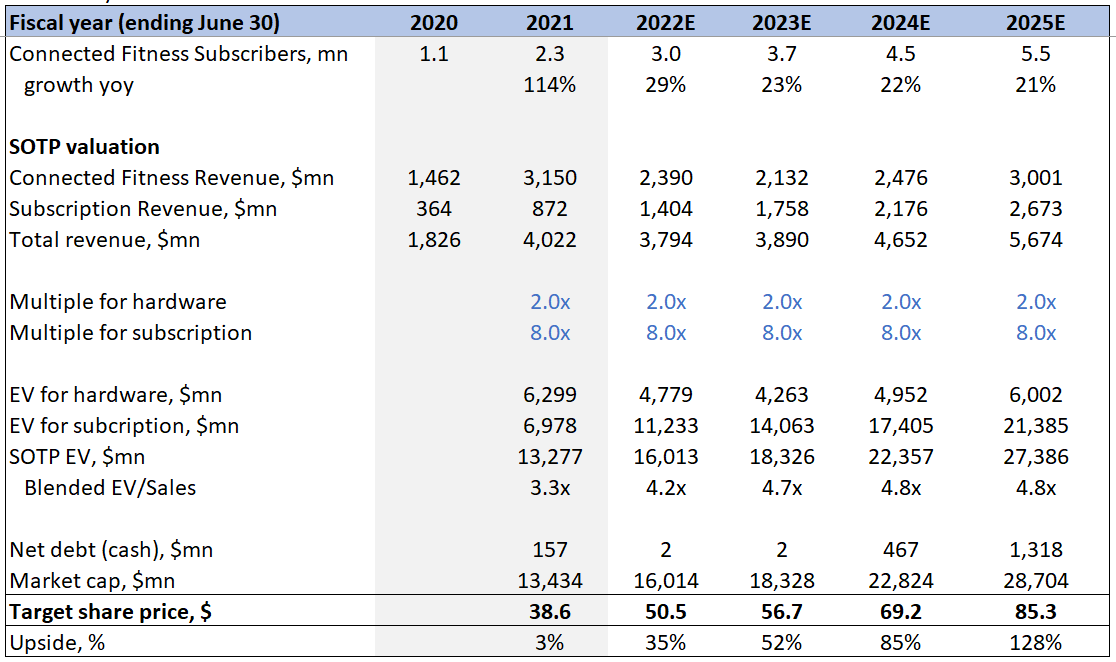

As for valuation, I prefer to use a simplistic approach which I borrowed from my friend together with his Peloton financial model (thanks, Dima!😉). Key assumptions:

3.0mn Connected fitness subscribers by the end of FY 2022 (company guidance), slowing down growth afterwards leading to 5.5mn by the end of FY 2025

Blended gross margin 28% 2022E → 43% 2025E

Hardware Gross margin recovering to 15% in FY 2023 and 20% in FY 2025

Software Gross margin 66% in FY 2022 → 69% in FY 2025

FCF $(1bn) in FY 2022E, zero in 2023E (maybe too aggressive, but they have a $1.6bn cash cushion to cover any reasonable deficit), 15% Revenue→FCF conversion in 2025E

Sum-of-the-parts valuation:

Hardware business: 2.0x EV/Revenue (Garmin trades at 4x)

Subscription business: 8.0x EV/Revenue (Netflix trades at 8.5x)

Shares outstanding: I’m using the fully diluted number share count of 317mn as of December 2021, I guess it may be higher if some employee stock options become in the money as the share price recovers

This results in $50-85 target price range depending on the assumed exit year, i.e. 35-130% upside from the current level. Given this combination of uncertainty and upside, I’m not sure that I would buy the stock now if I haven’t already held it. However, I find holding a stock psychologically easier than opening a new position, so for now I will continue to hold and observe. Maybe I’m also affected by my irrational attraction to turnaround situations. Yes, I know that according to a wise Nebraskan, “turnarounds seldom turn” but it is pleasant to believe that this time is different!