Nintendo Q3 FY 2022 results

This is my first experiment in publishing company write ups, so I would greatly appreciate your feedback (both positive and negative).

I have been following Nintendo ($NTDOY $7974.JP) since late 2020 and built a large position in Q1 2021 (~15% of portfolio) as it looked like an idea with limited downside and quite a lot of upside optionality while being reasonably valued (especially compared to growth stocks madness at that point). In hindsight this definitely looks like not the best entry point as the stock was punished for weak 1H FY 2022 (Apr-Sep) results. However, it fundamentals seem to be improving since Autumn 2021 with the launch of Switch OLED and a number of best selling games. I am not a fan of Pokemon (BDSP sold 14mn units in Q3 FY 2022), but I bought Metroid Dread (2.7mn units sold) and even managed to kill the first boss; I must admit the game is pretty cool! The good thing about owning Nintendo is that I can always tell my wife that I’m doing due diligence, not just playing video games.

Jokes aside, judging by the dynamics of the last three quarters, most of the parts of my initial investment thesis are either confirmed by facts or at least not disconfirmed by them. Given this, I continue to hold the stock and observe.

Key parts of the investment thesis

✅ Switch having a longer cycle vs previous generations

❔ Transition from the boom & bust cycle to iterative HW model

✅ Transition to digital software sales (higher margins)

❔ IP monetization

❌ Mobile gaming upside

✅ Reasonable valuation

Hardware and software sales

It should be noted that all financials are presented in yen which depreciated by ~5% against USD, positively affecting revenue and profit in yen

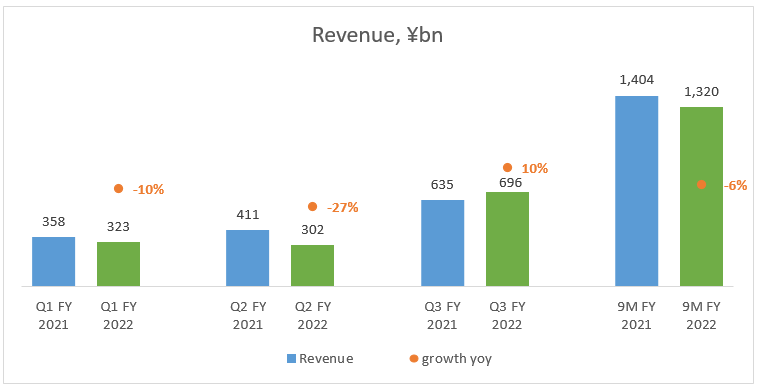

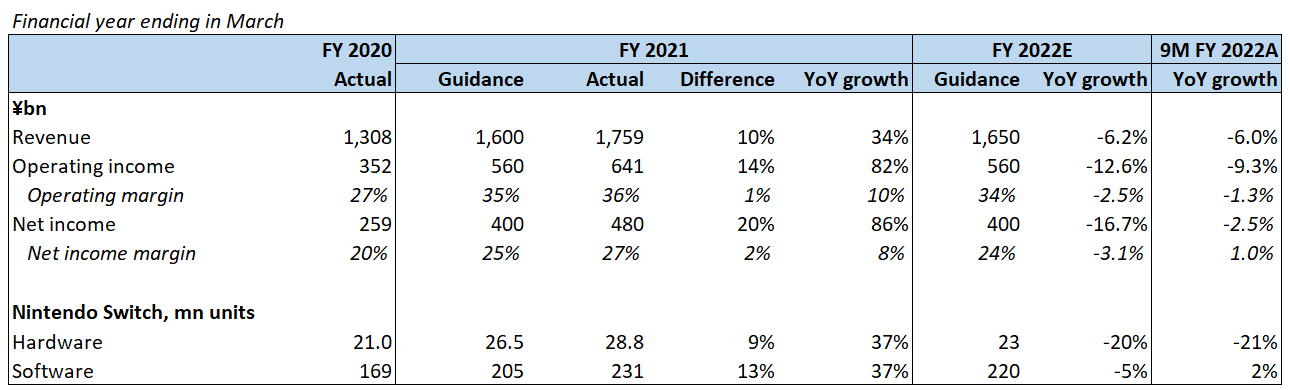

Net sales -6% yoy in 9M FY 2022

Sales of video game business -6.1% YTD, including +4.5% effect of FX rates on ¥ sales. This is against hard comps as FY 2021 sales were extraordinarily high on the back of Animal Crossing’s success (in FY 2021 40% of new Switch customers bought Animal Crossing as their first game). However, Q3 FY 2022 sales still became the 3rd largest Q3 sales in history

Mobile, IP related and other income -5.2% YTD as mobile declined while royalty income increased.

There are no indications of mobile picking up or the company paying attention to it. I had some hopes on Pokemon Unite (MOBA in Pokemon universe), but apparently it didn’t become a hit

No big moves in IP monetization, the next milestone is Mario movie (expected to release in Dec 2022)

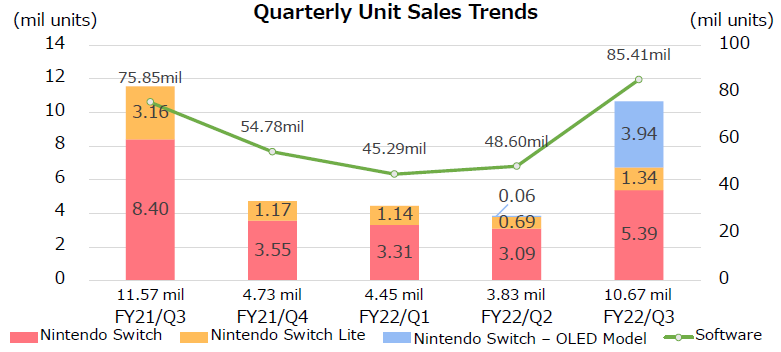

Switch sales:

Lifetime sales of Switch exceeded 100mn units (sell-through, i.e. sales to end customers; earlier Nintendo had expected this to happen by March 2022)

Total Switch unit sales -21% YTD / -8% in Q3 yoy

Switch -30% / -36%. Gradually getting replaced by Switch OLED.

Switch Lite -57% / -58%. Such a dramatic fall seems to be the consequence of inflated sales during the pandemic when people were ready to buy anything that was in stock (regular Switch was often hard to find)

Switch OLED: 4mn units sold since launch in Q3 FY 2022 (37% of total Switch sales in the quarter). OLED is being purchased both as a replacement and as an additional system

Scarcity due to delays in production and distribution, especially in North America

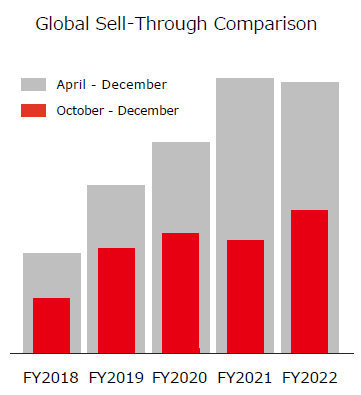

Sell-through unit sales in Q3 were 2nd highest since the launch of Switch

Annual playing users – those who have logged in and played a game at least once in the last 12 months

Software sales

Software unit sales 179mn YTD / 85mn Q3 (+2% YTD / +13% Q3 yoy), supported by Pokemon BDSP (14mn units) and Mario Party Superstars (5.4mn units)

Sell-through (sales to end customers):

Q3 FY 2022 saw the highest quarterly sell-through of 1st party software since the launch of Switch

Animal Crossing exceeded 10mn units in Japan alone making it the top selling game in Japan in all history

Share of 1st party software sales 84% in Q3, 78% YTD (below historical average of ~80% due to less 1st party releases in 1H FY 2022)

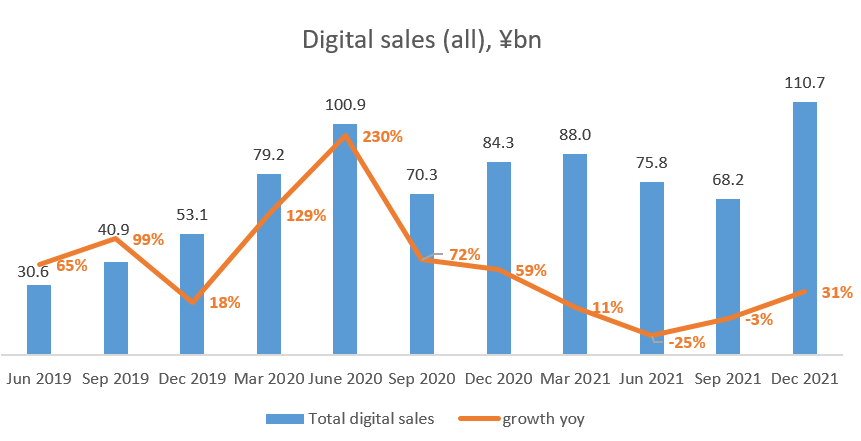

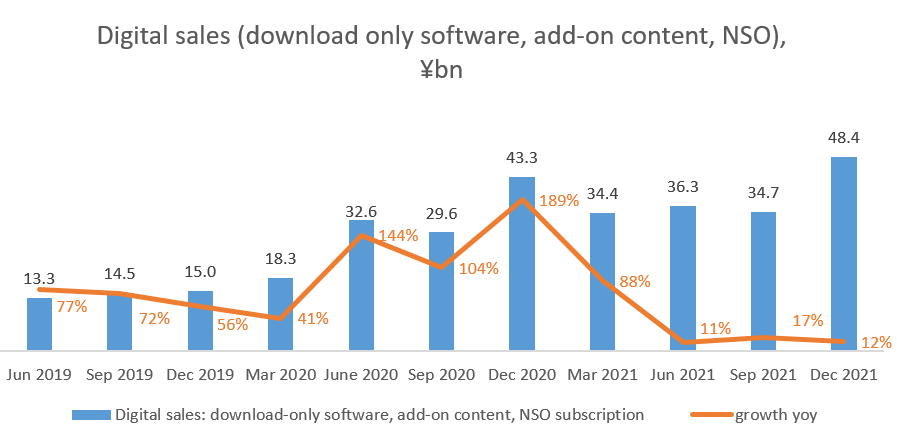

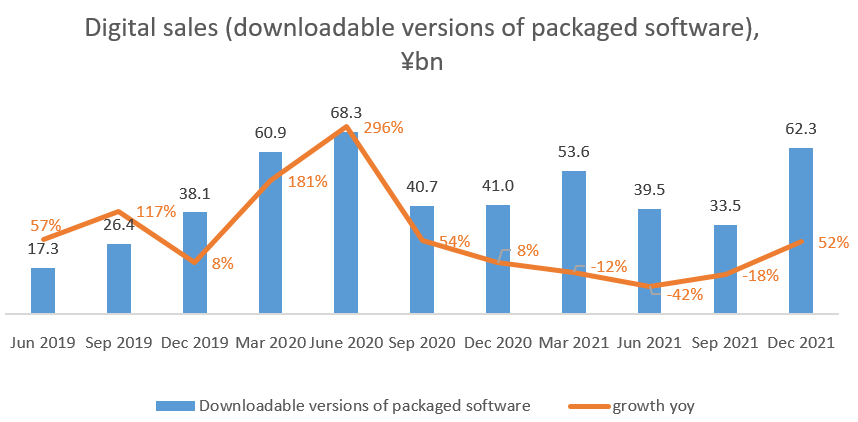

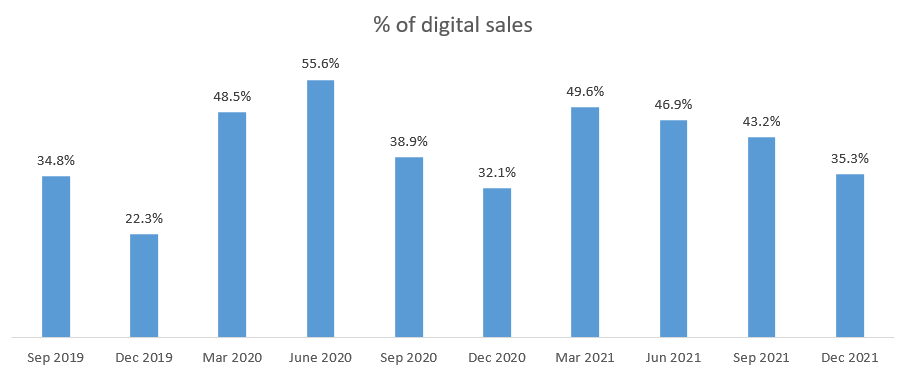

Digital sales -0.4% YTD / +31% in Q3 yoy (vs -16% in 1H 2022)

Downloadable versions of physical software +52% yoy in Q3, all-time high

Digital-only software, add-ons and Nintendo Switch Online +12% yoy in Q3, up 3x vs Dec 2019, all-time high

Share of digital sales was traditionally lower in Q3 due to holiday season (grandmas prefer to put something tangible under the Christmas tree) but increased by 3.2pp yoy to 35.3%

Notable releases:

Q4 FY 2022:

Pokemon Arceus (Jan 2022) Already selling on par with Pokemon BDSP (which sold 14mn copies in Q3 FY 2022!) according to some preliminary data

Kirby and Forgotten Land (March 2022)

Calendar year 2022:

Sequel to The Legend of Zelda: BOTW (although I have a feeling that this will be postponed to 2023)

Splatoon 3

Bayonetta 3

Advance Wars 1+2

Triangle Strategy

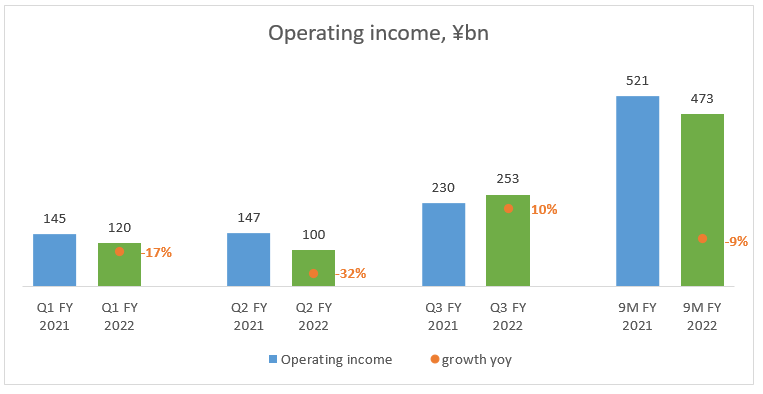

Key financials

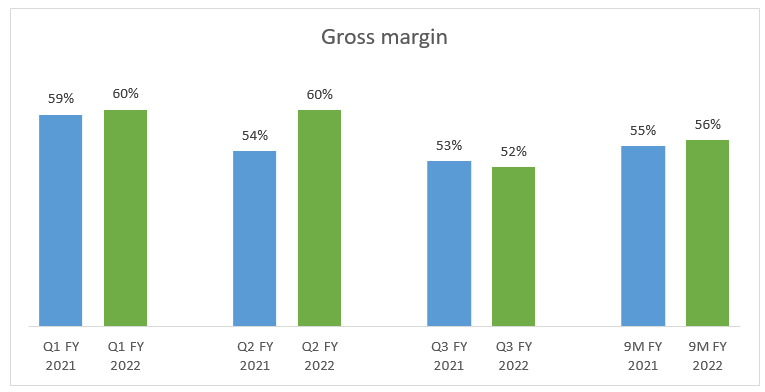

Gross margin increased +0.9pp to 55.6%, mainly due to FX effect of a weak yen. Switch OLED also has a lower gross margin compared to the original Switch

SG&A +5.6% yoy due to increased advertising expenses (+15.8%) on new software/hardware and weaker yen, while R&D expenses were flat (-2%)

FY 2022 guidance:

Switch sales: 23mn units (-4% vs previous guidance, -10% vs initial guidance), semiconductor shortage still affecting production plan. Hard to say whether it’s too conservative or not, I guess the key factor will be supply bottlenecks, not demand

Software sales: 220mn units (+10% vs previous guidance and +16% vs initial guidance). This looks overly pessimistic to me, especially as we already see strong sales of Pokemon Arceus

Key financials vs previous guidance:

Revenue +3%

Operating profit +8%

Net income +14%

Dividends +14%

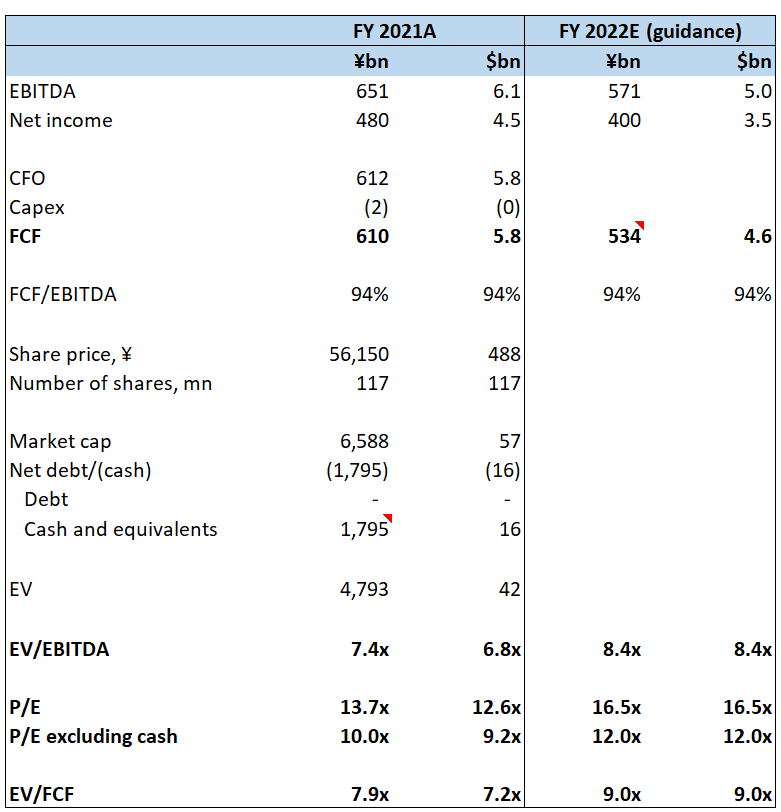

Balance sheet:

No debt

Cash & equivalents $16bn (including cash and investment securities classified as ST and LT assets)

Dividend yield: 3% dividend yield as per FY 2022E guidance and current stock price

Valuation

Nintendo stock is currently trading at 16x / 12x P/E (including/excluding cash) and 9x EV/FCF, all based on their rather conservative FY 2022 guidance

One may argue that cash should not be subtracted when calculating EV and P/E because the company may just continue piling it rather than use for dividends/buybacks/value-accretive M&As. It may be true, but even under this conservative assumption the valuation looks reasonable to me

Of course, there is a risk that they fail to transition smoothly to the next console generation, lose to cloud gaming or make some other strategic mistakes. But in my opinion the risks are largely mitigated by one of a kind IP the recycling of which Nintendo has mastered (just look at sales numbers for all those HD remasters and ports of old games as well as endless iterations of a few franchises)

I continue to hold the stock and observe