Peloton is almost a reverse 10-bagger for me (yet another term coined by Mr. Lynch). Probably it’s one more demonstration of irrationality, but now that the position size is ~90% below my cost basis, I actually feel much less emotional about it. Let’s see whether it’s just my unconscious desire to recover losses or some valid rationale for holding PTON now. We will start with the numbers before jumping to strategic and operational highlights.

Key financials and operating metrics

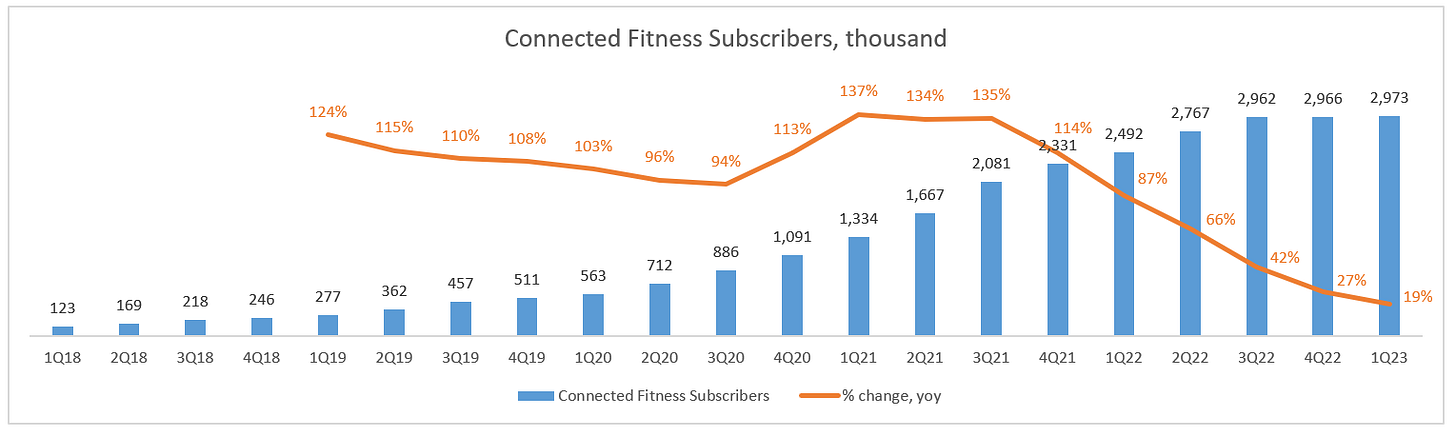

Subscribers have been almost flat for the last 3 quarters. The good news is that churn is still stubbornly low at 1.1% per month despite a 13% subscription price increase in June 2022. The bad news is that there is no working growth engine in sight yet (guidance for the next quarter implies just 30k net additions despite holiday sales), while Peloton still needs to scale to reach profitability. But at least they have cut sales and marketing expenses that were not leading to adequate subscriber additions.

Digital (app) subscribers are also not doing well, declining year-on-year for the first time. Peloton cites renewal timing of some corporate membership programs as the reason. This should probably read as users churning: they were fine with using the app as long as it was free for them, but are not willing to pay. Another possibility is that some significant corporate customers stopped their collaboration with Peloton. In any case digital subscription was not supposed to be a meaningful revenue driver, rather a marketing channel for incentivizing users to buy Peloton’s hardware. This may change with the announced launch of a new Peloton App strategy in early 2023 which will feature tiered pricing, but for now the segment remains stagnant.

Revenue dynamics looks like a disaster at first glance, but an optimist may see some bright spots if we look at revenue structure. Starting from the previous quarter subscription revenue has surpassed hardware revenue and the difference increased in the last quarter. High margin recurring subscription revenue now accounts for 2/3 of total revenue, although the latter compressed 23% year on year.

Hardware revenue is in free fall due to a combination of factors: lower hardware prices, cutting back on marketing, probably weaker demand for discretionary goods in general and home fitness products in particular as people may prefer gyms or open air workouts after lockdowns economic reasons aside. There is also a notable effect (~5% of revenue) of increased Tread+ recall reserve provisions which are charged against revenue.

Subscription revenue is doing much better. While growth is not even close to the crazy pace observed in the last few years, subscription is still growing at ~35% year on year. Prioritizing subscription revenue is the essence of the new CEO’s turnaround plan, but Peloton needs to find new growth drivers as existing ones are drying up: subscriber additions were miniscule in the last two quarters and they will soon lap the 13% price increase introduced in June 2022 that supported revenue growth.

The abysmal hardware gross profit of the previous quarter was distorted by $180mn inventory reserve (mostly related to accessories and apparel), but it was bad enough even before accounting for the reserve which is likely a one-off. This quarter hardware gross profit got somewhat better while it was still affected by Tread+ recall reserve which does not relate to current activities (without this reserve the hardware gross margin would have been (12%) instead of (27%)). Subscription gross margin ticked lower due to additional spending on music licenses and higher stock-based compensation (by the way, including SBC in COGS looks unusual to me) but remains healthy. Subscription contribution margin is even slightly up year on year (71.3% vs 69.6%) which is definitely a good sign. The management is focusing on overall margins, so we may well continue to see depressed, even negative gross margins, while they are supposed to be compensated with higher subscription revenue.

Sales&marketing expense is finally getting more reasonable compared to revenue. The decline was driven mostly by cuts of advertising and marketing expense ($138mn), while reduction of personnel related expenses had only a minor contribution ($7mn). One may argue that S&M expenses are still way too high given that subscribers remained almost flat in the last 2 quarters. If the company needs to spend that much on advertising just to keep the existing subscriber base, this implies that the business model is not viable.

G&A expenses are also showing signs of normalization but still seem too high for Peloton’s current scale. The decrease was driven mostly by cuts of professional services fees and IT expenses ($46mn) as well as lower headcount ($18mn). What I don’t like is that the cuts were partially offset by a $23mn increase in SBC expense. I understand that Peloton needs to maintain the team’s motivation, but this looks too generous for a company that is fighting for survival. At least the CEO acknowledges the problem as he admits that expenses are “structurally broken” and “G&A needs to come down as a percentage of revenue”.

I’m still puzzled why they need that much R&D expense. Is the technology behind Peloton’s products really that sophisticated? Can’t they pass at least part of R&D to suppliers now that manufacturing is outsourced? The same worrisome SBC theme is present here too: lower development costs ($10mn) and headcount ($7mn) were partially compensated by higher SBC (+$13mn).

Peloton also recorded a large, presumably one-off restructuring expense of $107mn which included $77mn SBC (related solely to severance arrangements if I’m reading this correctly) and $27mn cash severance payments. Total SBC expenses still look crazy given the current state of the business: $182mn for the quarter!

Cash flow dynamics present probably the most compelling evidence that there is light at the end of the tunnel. Capex is back to more or less reasonable levels while the company has not yet sold its production facility (Peloton is completing construction works before selling). Most importantly there is visible improvement in cash flow from operations.

$203mn operational outflow includes $25mn of one-off expenses (severance payments and professional fees and it’s not the end yet - they will still need to pay ~$70mn of severance and other exit costs in FY 2023). So the “true” OCF for the quarter was ~$(170mn) of which $(180mn) was contributed by reduction in accounts payable and accrued expenses, mostly due to slower procurement of inventory, while inventory release contributed +$110mn. It should also be noted that Peloton is paying its suppliers for cancellation of legally binding production volumes that they now do not need. Given many moving parts it’s a bit hard to estimate the recurring part of OCF, but for now it looks like breakeven is not within reach even if we do not count SBC expense (which is obviously not fair because dilution is a real cost for shareholders).

~$200mn negative FCF per quarter against $940mn cash & equivalent plus $500mn untapped revolving credit line means that the company may survive for another ~1.5 years before it runs out of cash - an uncomfortable, but not an extreme situation. In hindsight that $1bn equity raise at $46 per share in November 2021 looks like a great decision despite attracting lots of criticism at that time. Not even mentioning $1bn zero coupon 5-year convertible notes with $240 (yes, two hundred and forty) conversion price issued in February 2021 - essentially free money. Whether by coincidence or not, the previous management team did at least something helpful for Peloton’s survival.

Strategic/operational updates

“The ship is turning” - Barry McCarthy, quarterly shareholder letter.

The numbers provide some evidence that the CEO’s statement may be correct. But what is the ship’s new course then?

Barry named the following targets:

Breakeven or positive FCF (apparently excluding SBC, but let’s not be too strict for now).

To my mind FCF is just an observable outcome of achieving targets 2-3 and other initiatives (cutting opex, switching to outsourced manufacturing, etc), so inputs and outcomes are somewhat mixed here. It’s hard to judge when/if Peloton can achieve the target, but Barry’s plan is to reach FCF breakeven in 2H FY 2023, i.e. by June 2023.

Engaged members with high NPS.

Measuring this one has become tricky because Peloton stopped reporting workouts per member, the most straightforward engagement metric. It’s probably not a good sign: if the metric looked good, why would they remove it from the reporting pack? NPS has not been reported on a consistent basis previously and we don’t know the up to date number. So the only metric that we may use is subscriber churn - it’s not perfect, but likely correlated with engagement and NPS. As seen above, churn looks pretty good even after the subscription price increase, so members must be still loving the experience.

Growing subscriber base, continued low churn, lower CAC.

Continued low churn seems achievable, although I would expect more pressure on retention in a recessionary environment as people might start cutting back on non-essential services (maybe Peloton is an essential for some fans, but what is their share among total members?). The company may also need to raise subscription price again that would inevitably lead to higher churn and it’s not clear if they have already reached the price point that maximizes gross profit.

“Growing subscriber base” and “lower CAC” are the parts of Peloton’s strategy that I struggle with. They are conducting a number of experiments (launching new devices, offering hardware rental plans, distributing hardware through 3rd party retailers, etc; more on this below), but the hard facts are that the subscriber base did not grow in the last two quarters. Will they find a profitable growth engine that changes this? I don’t have any clues for now. What is more or less clear is that this business is probably not worth a lot with zero growth.

Recent changes and initiatives give us a feel of how the new management is trying to achieve its targets:

Peloton’s co-founder John Foley departed from the Board of Directors. By the way, John is now a rug guy: he has recently started a D2C custom rug company raising $25mn… One may argue that Foley is pretty good at rug pulling: he was selling Peloton shares at $90-160 in 2020-21

Replacement is completed or is in progress for the following roles: CFO, CMO, Chief People Officer, Chief Legal Officer, Chief Information Officer and Chief Accounting officer

Peloton’s bike rental program (“Fitness as a Service”, FaaS) has been expanded nationally after local tests. Basic Bike with subscription costs $89 per month, plus $150 set up cost. According to management, ~30% of new subscribers are coming from FaaS model

Peloton hardware is now offered on Amazon and at Dick’s Sporting Goods (100 retail locations and a webstore) while its own offline retail footprint keeps shrinking

Peloton devices will be installed in all 5,400 Hilton hotels in the US. Members of Hilton’s loyalty program will also receive a free 90-day trial for Peloton App and discounts on hardware

Launched sales of certified pre-owned bikes

Launched Peloton Row, a long awaited rowing machine. It’s available for pre-order only in the US and costs $3,195, deliveries will start in mid-November. Critics’ reviews are generally positive, but we need to see subscribers feedback

Peloton sold its manufacturing facility in Taiwan, production will now be outsourced (a 180° turn from the previous management’s strategy: they even started expanding in-house manufacturing)

Another 500 employees were cut in October (12% of remaining headcount), headcount is now down more than 50% from its peak. According to CEO, they are done with headcount reduction for now.

I don’t know which of these initiatives will work, but all of them make sense to me as an outside observer. Management quality is something that is hard to assess, nevertheless it is crucial for business performance. In addition to the turnaround plan looking reasonable, I definitely like the way Barry and his new CFO answered questions during the Q&A session as they both sounded rational and sincere. Probably just one statement appeared weird to me: the CFO referred to some “external research” to conclude that Peloton is likely to experience headwinds as the economy slows down, which should be obvious. But I have been wrong in assessing management multiple times, so this could be yet another illusion.

Valuation

Valuation is the most tricky part for me at this stage. Essentially we have a turnaround situation with a very wide range of outcomes: from bankruptcy to a profitable growth company with SaaS type revenue at the core. Potential returns distribution from the current state may resemble a call option (with a less extreme upside of course).

I’m using the same simplistic approach to valuation as I did previously but with some more pessimistic adjustments in terms of growth rates, margins and multiples. These assumptions may well turn out to be not pessimistic enough. For example, is there really any value in hardware revenue if hardware gross margin is zero or even negative? Is it reasonable to assign SaaS-like EV/revenue multiples if the business still has a lot of hardware related costs that are not present in pure software businesses? Finally, why should one assume that Peloton finds a way to grow subscriber base with a decent LTV/CAC to become profitable? On the other hand, I can come up with a number of more optimistic scenarios which could play out if some of Peloton’s current experiments are successful.

In any case, I believe there is a bunch of plausible scenarios that could lead to a share price several times higher than the current $10. The question is how the probabilities are distributed. My intuitive conclusion is that risk/return is not bad at the current price, so I continue to hold PTON. But I have been wrong multiples times and I may be biased due to an unconscious desire to make up losses or to prove that my initial take was not totally wrong (yes, I know that both intentions are stupid, but we are irrational).