I’ve been a proud bagholder of Peloton since summer 2021. My percentage loss from PTON stock is second only to the loss from an obscure biotech that I ventured into, while PTON’s loss in absolute terms is getting close to #1 spot in my portfolio. Apparently I have been overly optimistic about the turnaround potential when writing the previous piece on Peloton 3 months ago, shortly after arrival of the new CEO; I also underestimated how far the stock can fall, especially in the current market environment where most of unprofitable tech companies are getting annihilated. I guess sometimes you just need to accept new reality, cut the losses and stop the agony, while I seem to have a problem with such situations. Learning in progress… Anyways, as the cheap keeps getting cheaper, let’s see what’s going on with the business.

Operational metrics

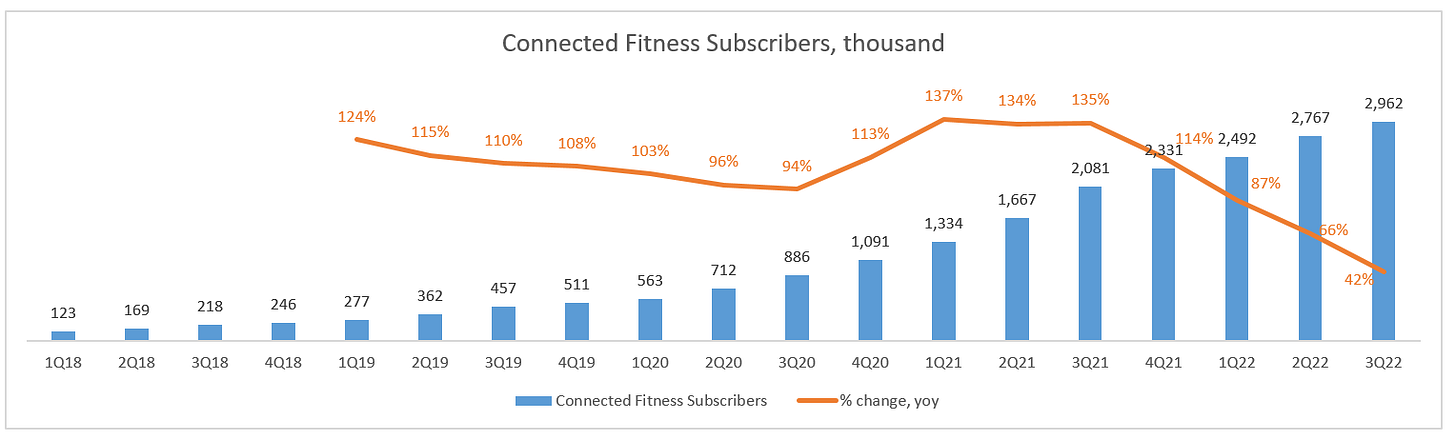

Growth rate trajectory looks like a straight downward-facing line. All those hardware price cuts don’t seem to be helping at all or at least not to an extent sufficient to overcome the pressure from the end of lockdowns.

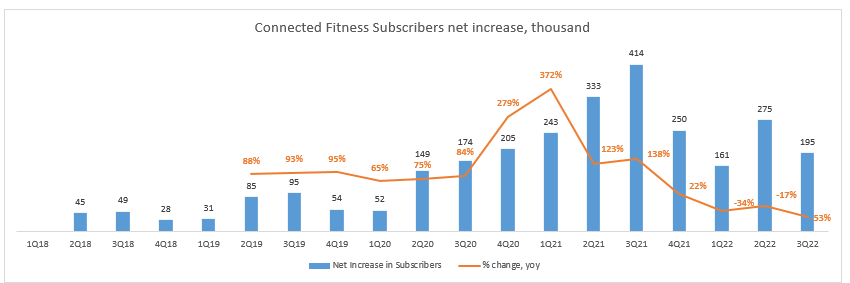

Peloton managed to add just 200k net subs which is pretty weak for traditionally strong Q3, especially given that they are still investing in marketing (sales&marketing spend was $228mn in Q3 FY ‘22 vs $208mn a year ago).

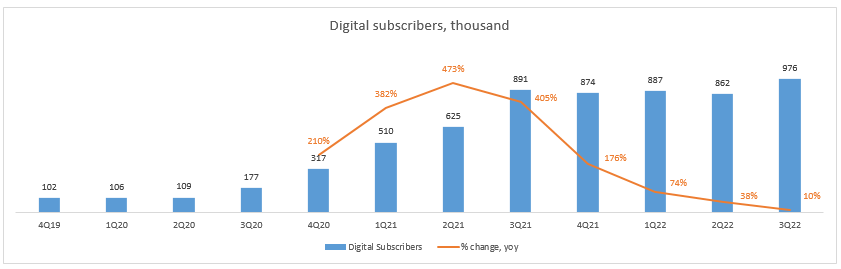

The digital subscribers trend is quite similar: sharply decelerating growth despite Q3 normally being the strongest quarter (New Year resolutions are still a thing). Corporate wellness is said to be contributing to growth, but numbers were not disclosed. Management believes that there is a lot of untapped market potential in digital with just 4% unaided brand awareness for Peloton digital app - most people still think it’s just a bike company.

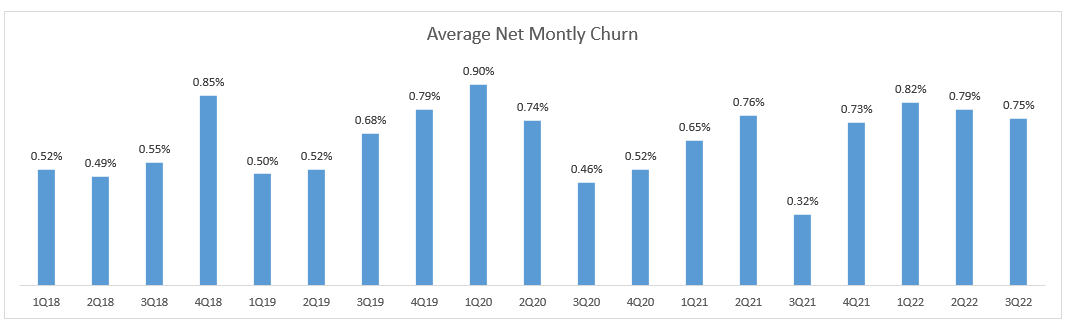

Churn is one of the few bright spots here. Although it’s up sharply vs record Q3 of 2020 and 2021 when everyone was locked at home, anything below 1% is still decent in my opinion. I can imagine the metric is under pressure from users who are deciding to abandon Peloton after the re-opening but apparently there are not too many of those.

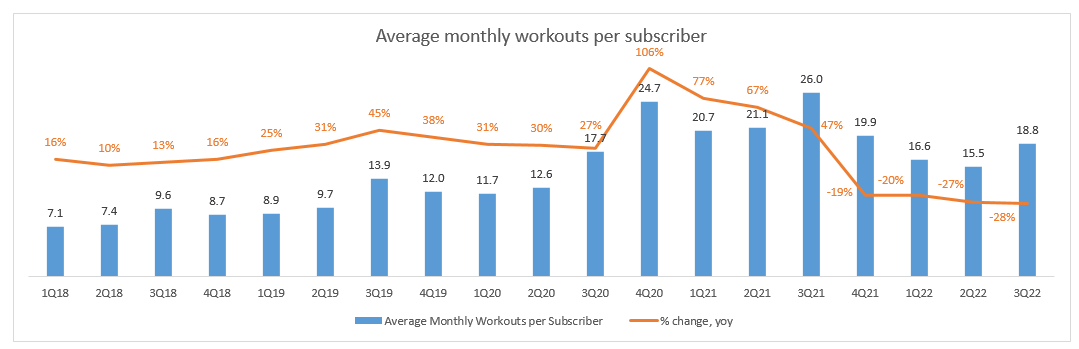

User engagement as measured by average monthly workouts per sub is unsurprisingly trending down, but not falling off a cliff as one may expect in a post-pandemic world. 18.8 workouts per month is still 35% higher than pre-pandemic Q3 FY 2019. So, a combination of low churn and relatively high engagement gives some hope.

A puzzling controversy: stubbornly low churn, fanatic audience that loves the product (e.g. as of February 2022, Peloton was #2 in the the most admired brands rating losing only to Apple) and a dysfunctional business model. I can’t think of any other large-scale products that were so popular for a prolonged time yet completely failed as a business. Is Peloton going to be the first one?

Financials

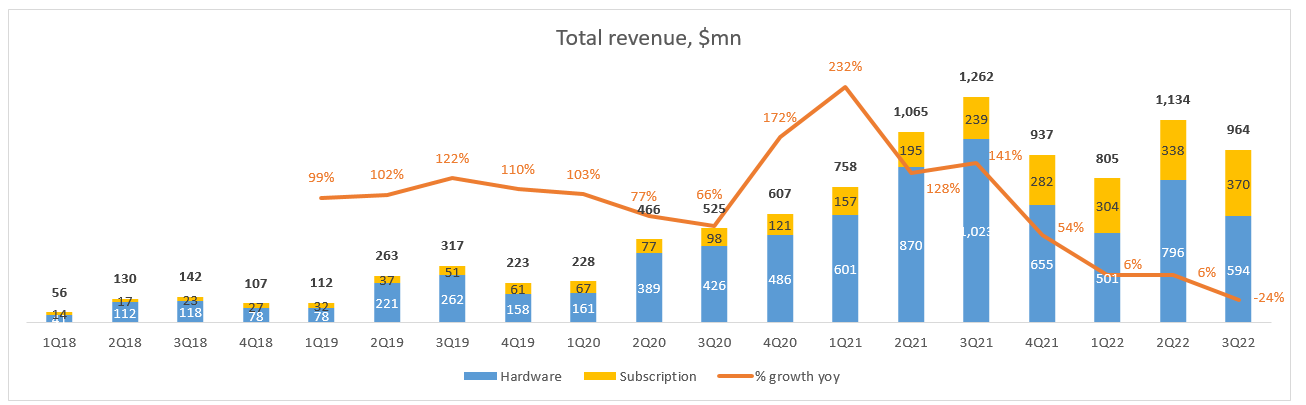

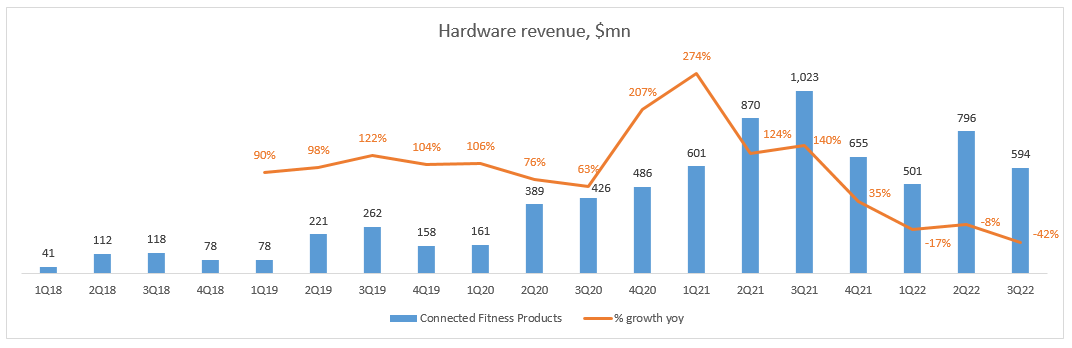

Revenue dynamics (-24% yoy) seem to be a disaster at first glance, but we need to look under the hood as hardware and subscription revenue streams are behaving differently.

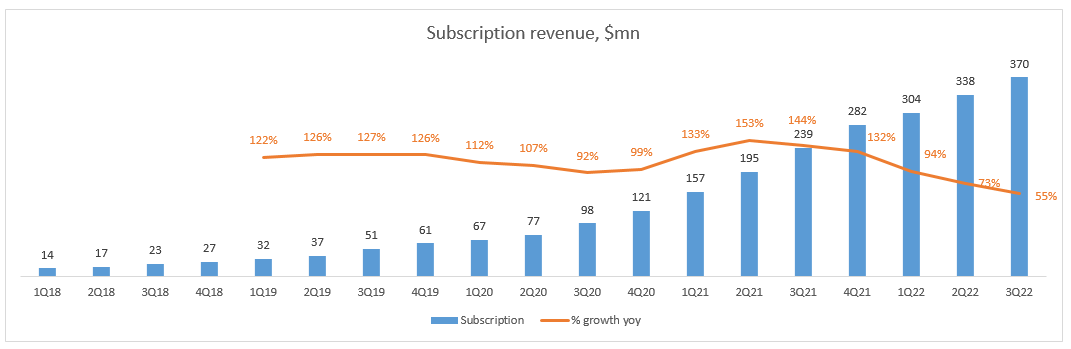

While Peloton printed a disastrous -42% yoy in hardware revenue as a result of price discounts and less units sold, subscription revenues are +55% yoy (even before the ~13% price hike that they have recently introduced). The hardware/subscription revenue mix changed from 81/19% a year ago to 38/62% this quarter. The absolute scale of SaaS revenue is also getting serious: Q3 FY ‘22 implies $1.5bn annual run-rate.

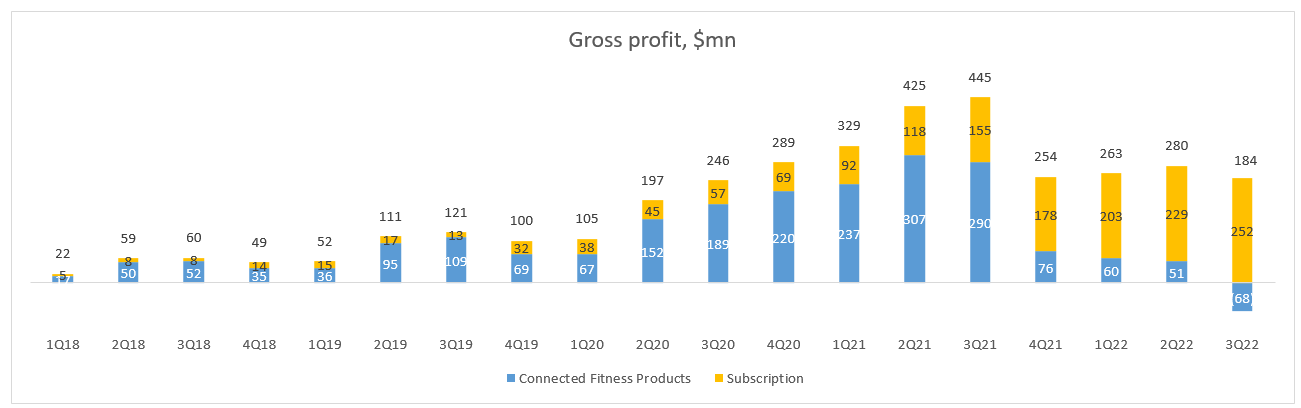

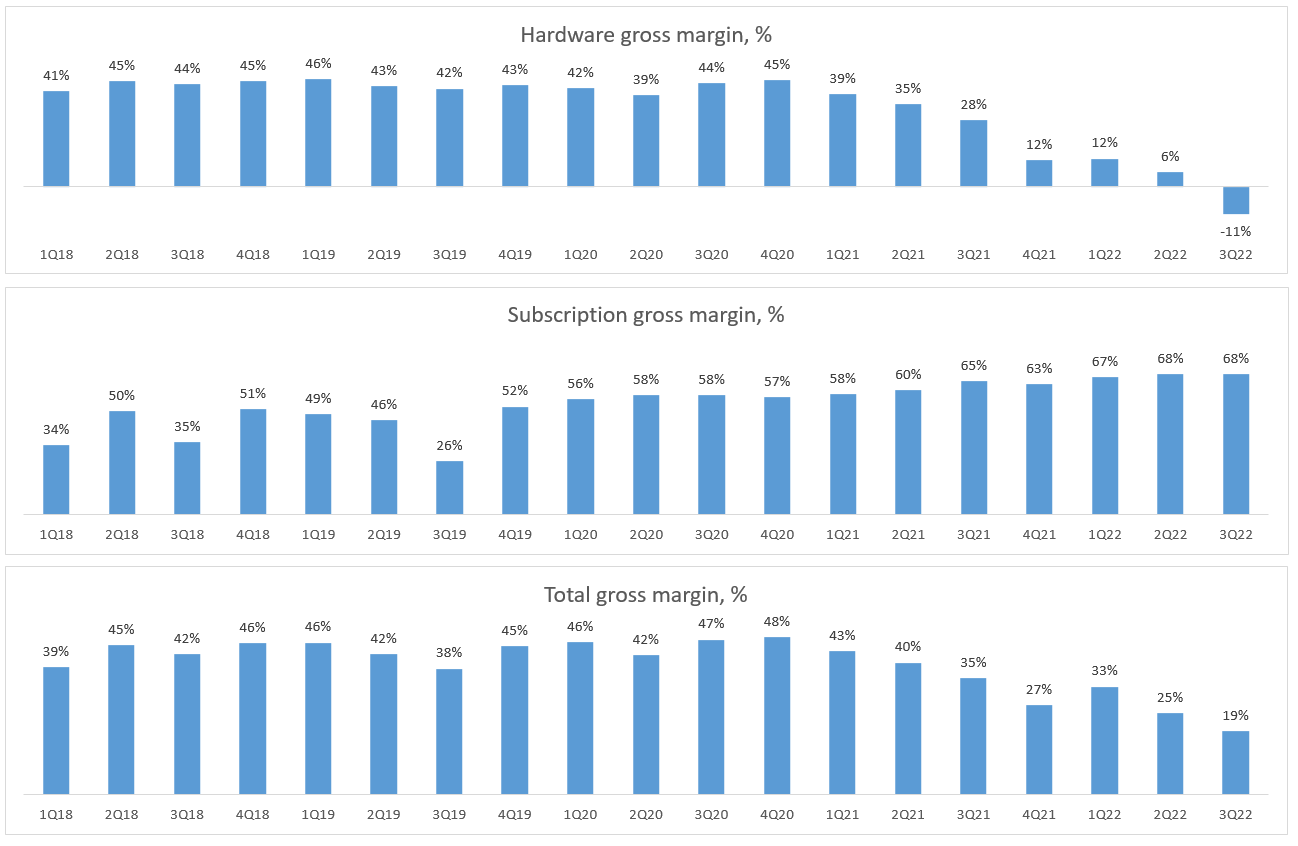

Even the minor expansion of hardware install base came at a cost: hardware gross margin turned negative to (11%) driving the blended gross margin to an all-time low of 19%. In addition to hardware price cuts, hardware margin was also affected by a write down of accessory inventory, higher logistics costs and Tread+ recall charges (~$19mn in Q3). In contrast to hardware, SaaS margins notably improved from 64.6% to 68.1% yoy thanks to fixed costs leverage. SaaS contribution margin stands even higher at 71.7% vs 68.4% a year ago, although there doesn’t seem to be a lot of room for improvement as most of SaaS costs are variable.

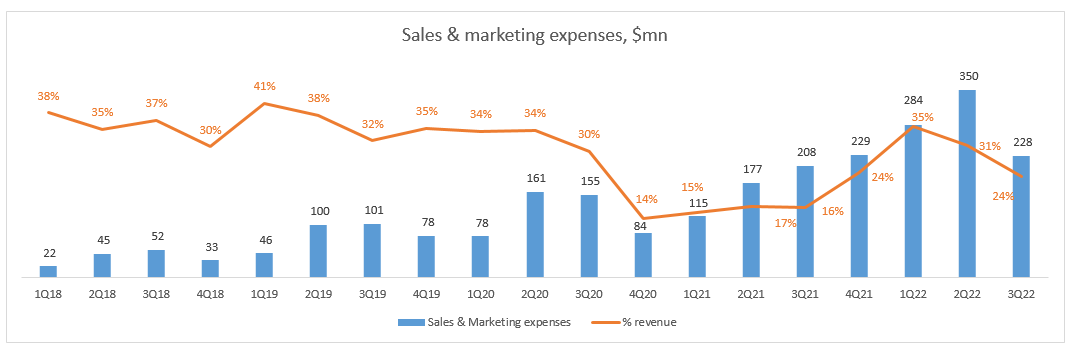

Sales & marketing expenses (+9% yoy) remained elevated both in absolute terms and as a percentage of revenue. Most importantly, even with this level of spending revenue growth was subdued.

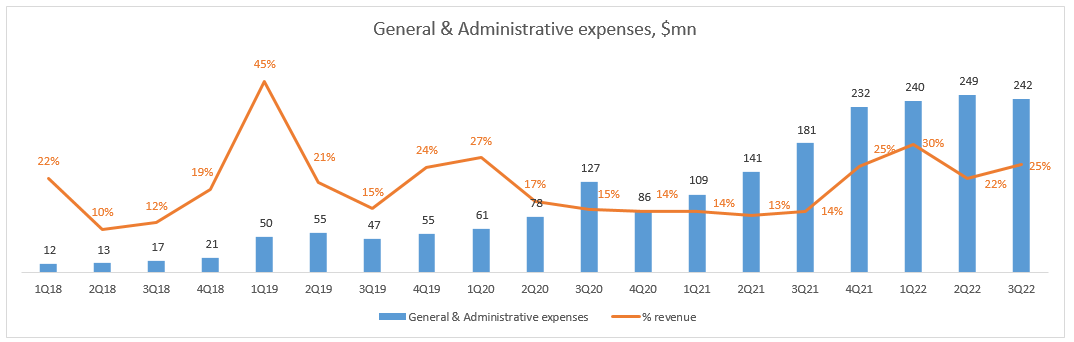

G&A expenses (+34% yoy) are also hardly displaying any effects of cost-cutting initiatives, but I guess we should defer judgment until at least the next few quarters. The majority of cost cutting measures are expected to fully kick-in in FY ‘23.

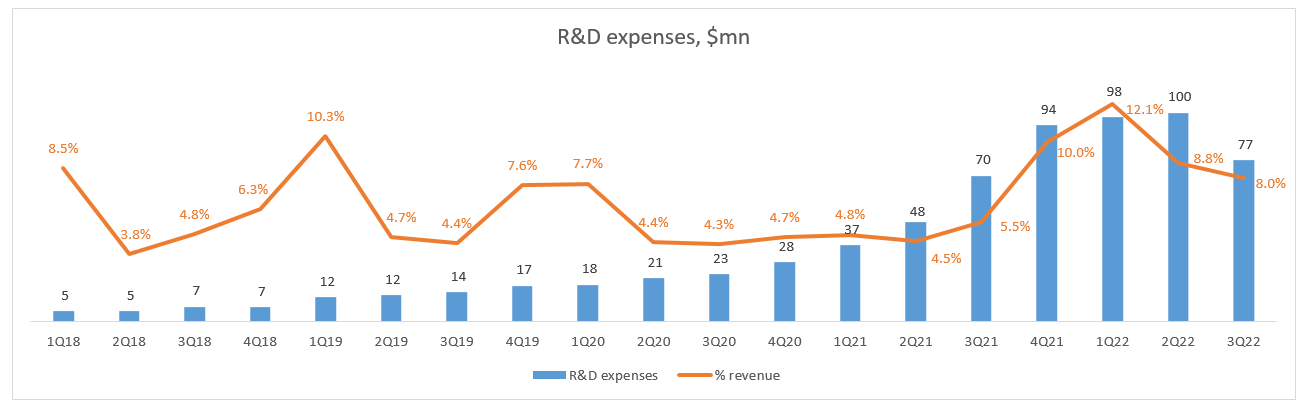

R&D expense (+11% yoy) growth is not that dramatic. However, at current scale of the business the $400mn run-rate of R&D expenses looks somewhat aggressive. Even more so considering that Barry McCarthy is switching Peloton’s focus from hardware to software. Do they really need to spend that much? I’m not sure, but the new management hasn’t named R&D among the sources of any significant cost cuts.

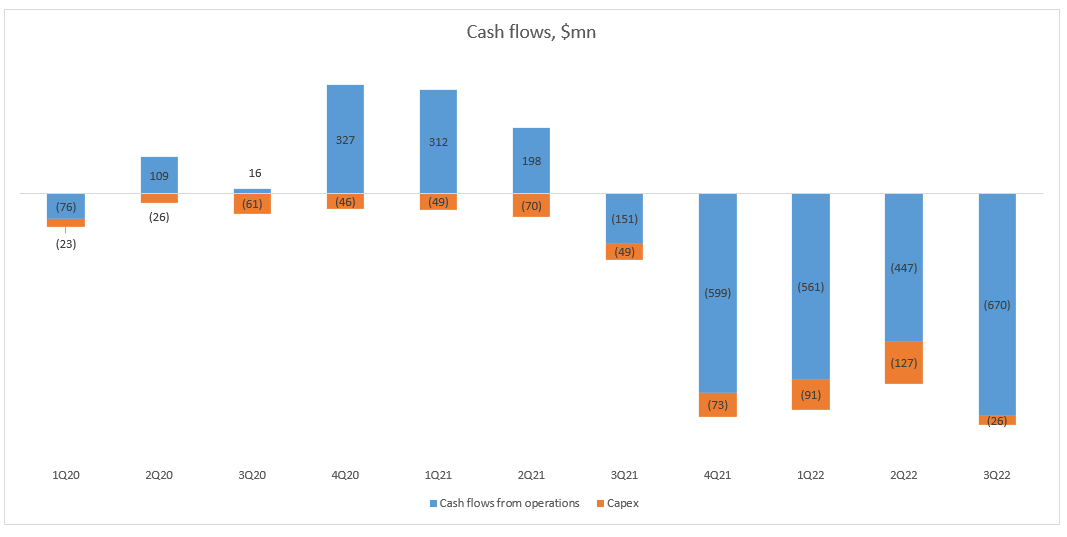

The cash burn is still mind-blowing. Looks like they have at least tamed capex, but the OCF outflow is at all time highs. It’s hard to blame Barry McCarthy as he has been CEO for just 7 weeks before the end of the quarter and judging by his comments he was surprised by the pace of cash burn himself. Key drivers of a humongous cash outflow were excessive inventories, higher storage and logistical costs.

Balance sheet

I guess one of the most popular questions among investors is how much money and in what form Peloton needs to raise before reaching positive free cash flow. Barry McCarthy fueled investors’ worries after stating in the shareholder letter that the company was “thinly capitalized”. He later tried to ease the fears during the call:

… with respect to free cash flow, the objective here is to get the business to positive free cash flow in FY '23, just full stop. And with the money that we raised in the term loan, I'm very confident. We've got plenty of capital to do that, regardless of what happens in the economy, full stop.

In May 2022 Peloton entered into a binding commitment to raise a 5-year $750mn senior secured term loan. According to Bloomberg, the term loan arranged by JP Morgan and Goldman Sachs has been more than 2x oversubscribed and was priced at ~8% yield to maturity. The creditors will also be getting some extra profit if the company gets bought out (details are not disclosed). I’m not an expert in fixed income, but judging by YTM, investors are not as confident as Barry and may be assigning a pretty significant probability of default.

Outlook and strategy

In Q4 FY 2022 the company expects almost zero net subscriber additions (number of subscribers 2.96mn→2.98mn in Q3→Q4), $683mn revenue (-27% yoy) and 31% Gross Margin. Gross Margin guidance implies a meaningful improvement from the last two quarters, but hardware margin will remain negative due to price reduction, higher storage costs for keeping excess inventory and elevated logistics costs.

What I definitely like about the new CEO is his clarity, openness and readiness to admit mistakes in public (e.g. he admitted “substantial tech debt” and mistakes in execution when engaging 3PL partners for delivery). Most importantly, Barry accepts the reality (which the former management failed to do in my opinion) and clearly communicates the plan, while also highlighting the importance of experimenting and adjusting on the go. Peloton’s ultimate goal (BHAG in Jim Collins’ terms) remains the same: a global connected fitness platform with 100mn members (~50% of global gym memberships). Here are the strategic priorities as Barry puts them:

1. Stabilizing the cash flow

There is too much inventory for the current run-rate, although inventory does not go obsolete and will be sold sooner or later. Expecting a cash inflow from inventory release in FY ‘23

As announced earlier, cost cutting goal remains at $800mn run-rate savings p.a. by FY ‘24 ($500mn in Opex and $300mn in COGS). Opex targets: $165mn in 2H ‘22, $450mn in FY ’23; COGS targets: $30-35mn in 2H FY ’22 and $100mn in FY ‘23

2. Getting the right people in the right roles

Appointed new head of supply chain

New additions to the team are likely as the focus shifts from hardware-centric to software-centric business model

3. Growing again

Broadening distribution to 3rd party retailers (no details yet, discussions are at an early stage)

Rethinking value proposition for the digital app to drive more “top of marketing funnel growth” (i.e. attracting more paying users via the app, potentially monetizing them directly through app subscription without hardware). The app’s potential is illustrated by unaided brand awareness which is just 4%

Expanding international markets. There is no clarity on specific geographies yet

Testing and broadening the roll-out of Fitness-as-a-Service (FaaS), a rental program that combines the cost of equipment and subscription in one monthly fee. The company is already testing various price points and seeing a steady increase in growth. FaaS will remain complementary to the core business, but it helps to capture lower income customers (53% of Peloton users have household income of less than $100k)

Recent price changes (cheaper hardware, more expensive subscription) may deliver ~$40mn of incremental revenue monthly. Price cuts drove daily unit sales by +69% and increased revenue by $25mn per month (approx. +50% vs baseline growth before the price change). Price increase for subscription will add $14mn in monthly revenue while increasing churn only modestly

The company is also changing the approach to marketing spend: they used to focus on Gross Profit from hardware compensating SaaS CAC, now switched to evaluating LTV vs CAC. Peloton is planning to add subscribers until marginal LTV falls to marginal CAC. My interpretation is that they may even sustain a negative Gross Margin on hardware as long as LTV is sufficiently high (notably, the current LTV/CAC cited by Barry is pretty low ranging from 2 to 3x depending on the season). In the meantime the company is still testing the relationship between CAC, churn and Gross Margin.

Product updates

On April 5th Peloton soft-launched Peloton Guide, a dedicated strength training product priced at $295. Owners of other Peloton hardware will not be paying extra subscription fees, while new users purchasing Guide will enjoy a discounted first year of membership for $24/month with the rate going up to the standard $44/month afterwards. Reviews have been generally favorable (1, 2, 3), although Guide doesn’t look like a game changer in terms of attracting new users.

Another long-awaited announcement came out shortly after the quarterly results. Peloton’s “worst kept secret” as The Wired put it (due to multiple leaks) is a rowing machine. Details such as the release date or price are not available yet. The launch appears to be a logical step for Peloton as rowers are the third largest category of fitness equipment after treads and bikes but competition is already there: Hydrow and Ergatta are targeting the same home fitness audience.

Going back to Peloton’s core products, the Tread+ recall that took place in May 2021 turned out to be a bigger problem than initially expected. There is no solution yet: according to the company, the plan for Tread+ recall “is still being finalized”. Too bad, especially considering Peloton’s high hopes for Tread/Tread+: former management stated that the market potential for tread products was 2-3x higher than that of Bike.

In February Peloton launched Lanebreak, a gamified experience for Bike/Bike+. The reception has been pretty positive with 500k+ members trying the game (the number of recurring users was not disclosed). Based on the successful launch, the company plans to add more gamification features to the training process.

In March the company launched Apple Watch integration for workouts on Bike, Bike+, Tread, and app. I’m not sure why it has taken them that long as this integration sounds like a no-brainer given the intersection between Peloton’s and Apple’s user base. But it’s better late than never.

Finally, Peloton added a “Just work out” feature that looks minor at first glance but may actually help to keep the audience engaged. The feature allows to record any workout even not involving Peloton’s equipment, so that the workout counts toward streaks, achievements and challenges within Peloton app.

Valuation

In the previous write-up on Peloton back in February, I estimated fair value at $50-85 per share. Of course, price drives narrative to some extent and there is also an anchoring effect, but that range looks pretty aggressive from where we are today.

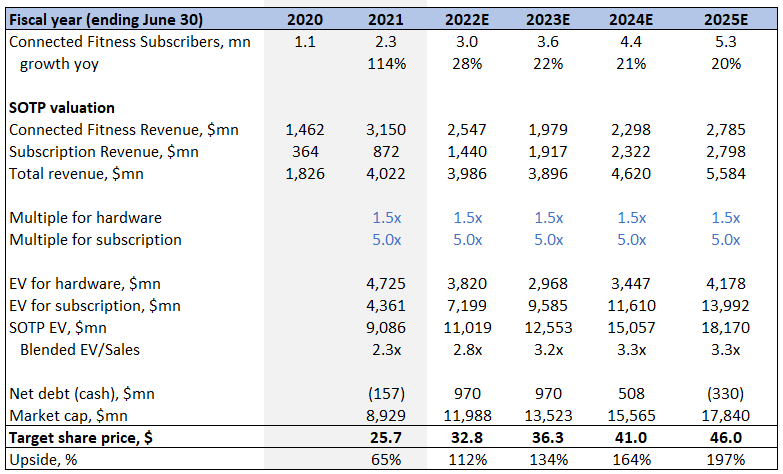

As we lack details on potential evolution of the business model such as transition to FaaS and more focus on app monetization, I prefer to use the same simplistic sum-of-the-parts approach valuing hardware and SaaS components separately.

Garmin, the core comp, still trades above historical average if we exclude the abnormal spike of 2007. To be on the conservative side and keeping in mind that Peloton is likely to keep hardware margins very low, let’s use 1.5x EV/Sales for Peloton.

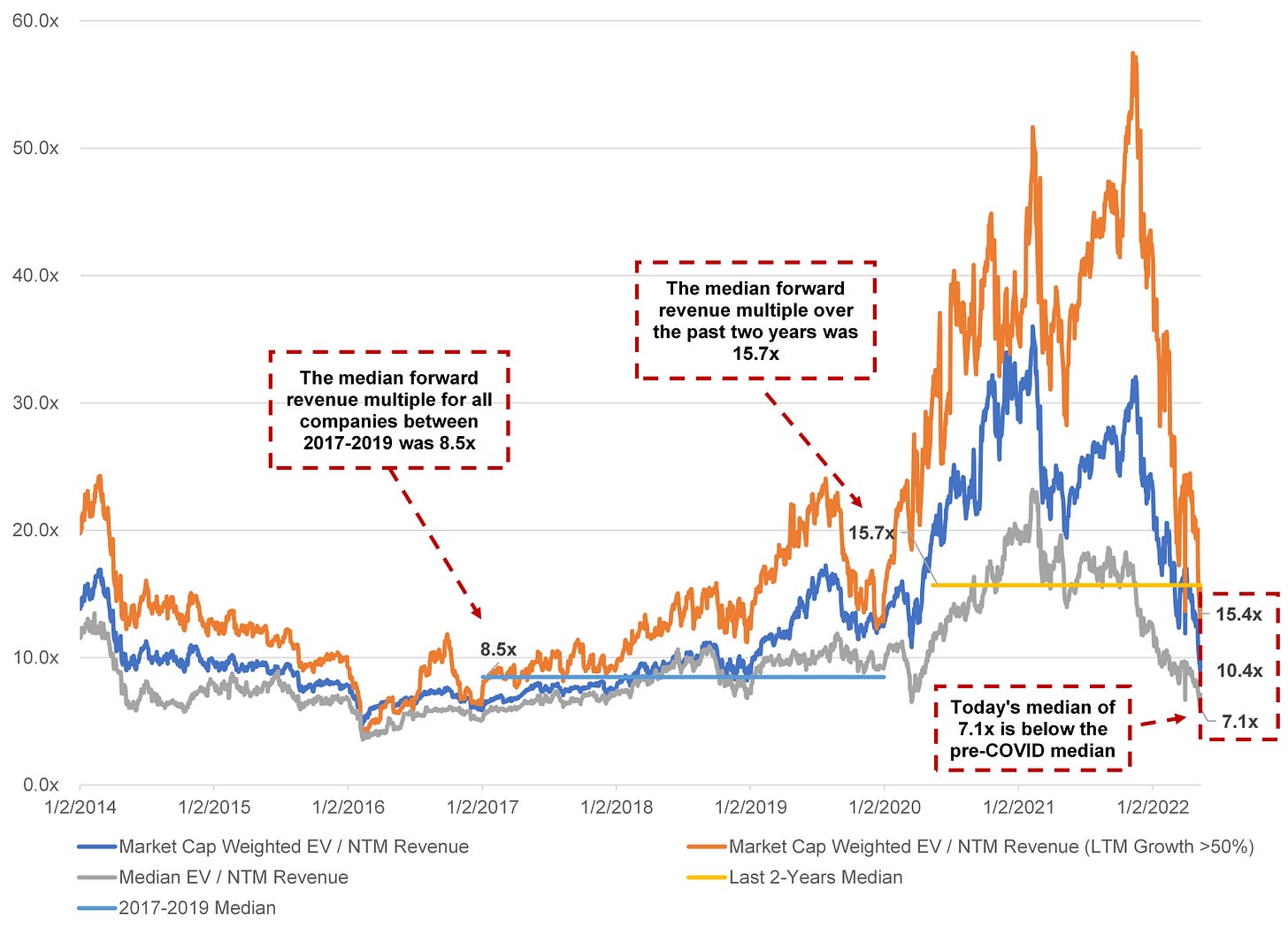

The case with Peloton’s SaaS component is less straight-forward. If we consider Netflix to be the closest comparable, we get a huge variation of EV/Sales multiple. When growth fades the multiple rerating can be brutal as we have seen with Netflix falling from 9x in November 2021 to less than 3x in May 2022. If we assume that Peloton survives at all, we need to factor in some meaningful growth, because they are unlikely to survive at current scale. Assuming 20%-ish growth, 5x EV/Sales for the SaaS component looks conservative enough to me.

As a cross-check for Peloton’s SaaS segment valuation, let’s compare it with classic SaaS companies. In this space the multiples are also relatively low compared to the last 8 years with 7.1x median EV/Sales as per Meritech Capital’s report published in May. I believe Peloton with its 70% contribution margin and less than 10% annual churn qualifies as a close proxy of a classic SaaS business. Hence, a 5x multiple for Peloton’s SaaS revenue seems reasonable.

Assuming that next year Peloton can have the same net additions of subscribers as in FY ‘22 (670k) and increase the number of net additions by 15-20% in FY ‘24-25, they may reach c. 5mn subscribers by FY ‘25. One of potential negative factors is higher churn but I think they stand a good chance of keeping it below 10% p.a. because we haven’t seen a pick up in churn as gyms reopened and people spend more time outside.

I also rely on Barry’s comments that the subscription price hike is not affecting the number of subscribers materially. For now it’s a big if and we will have more clarity on this assumption when we see Q4 FY ‘22 and Q1 FY ‘23 results as the new subscription ($39→$44/month) price becomes effective as of June 1st, 2022.

Finally, there is an existential risk that is tricky to price. I can easily imagine a scenario in which growth boosting and cost cutting initiatives fail and Peloton runs out of cash. Even in this case some shareholder value may be saved by an acquirer, but so far we haven’t seen any tangible proofs of interest despite numerous claims that Peloton is an attractive acquisition target for Apple, Amazon and other big guns. I guess the bankruptcy risk is real and some additional discount to the value derived from a standard valuation framework is warranted.

I still haven’t sold any shares as the risk/reward at current share price (~$15) is not that bad from my perspective, potentially 2-3x within a few years. But I drew the same conclusion at $100, $65, $40 and $30, so you shouldn’t listen to me! In the meantime I’m inhaling hopium and continuing to hold.

Solid article! I think everything is fair, but I just don't agree with the SaaS multiple. I think it should be much higher given the small amount of TAM that they've actually conquered to this point. If they were at 20% total TAM, then I'd say that multiple should come down, but there's a lot of green pasture ahead.