Peloton: pulse check

A glance on quarterly results

The good news for longtime bagholders of PTON like myself is that the business is still alive and kicking. The bad news is that while decisively implementing reasonable changes, the new management is far from proving that the company can survive and prosper. Below is my take on the recent numbers. Spoiler: they are not bad, but not too optimistic either.

Key financial and operating metrics

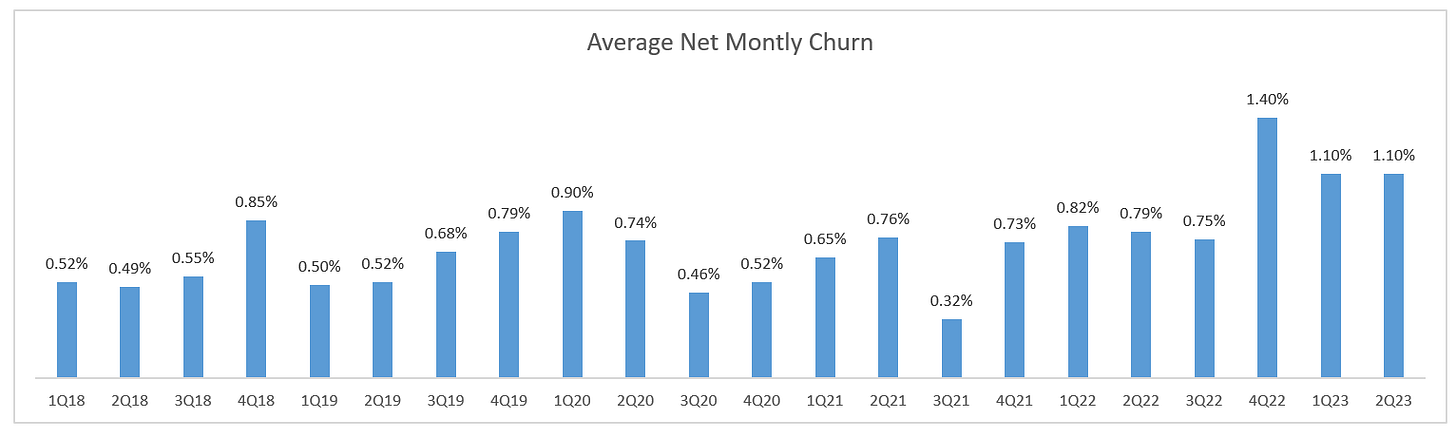

Connected fitness subscribers ticked higher supported by stubbornly low churn (1.1%), Black Friday/Cyber Monday demand (i.e. discounts), secondary market activations, bike rental program and faster delivery. Peloton’s likely sandbagged guidance implied 30k net adds, but they managed to add 60k (+2% qoq). As far as I am concerned, even such a minor increase is good enough in the short term as they are focusing on cost cutting and stabilizing cash flow. But I don’t see any signs of a new growth engine yet, while growth is critical as they are unlikely to become profitable at current scale.

Digital subscribers (Peloton app users without a device) are stagnant as expected. The company still plans to relaunch the app introducing tiered plans, but so far they haven’t announced anything specific. In the previous quarterly update they named “early 2023” as the planned launch date of the new app strategy, so we should probably expect an announcement soon.

A few quarters ago Peloton stopped reporting the number of workouts which is not a good sign per se: who would stop reporting a metric that looks good? So we are left with third party sources. According to Revealera, workouts are down materially, which is not surprising given miniscule growth of connected fitness subscribers and some existing users substituting Peloton classes for out of home sports activities.

Interestingly, members per device are also in a steady downtrend. The metric is now 21% lower even compared to pre-covid quarter ending in December 2019. I’m not sure what the root cause is. High numbers during lockdowns look logical: everyone was locked at home, so more family members were nudged to try Peloton, but what about pre-covid? Can the downward trend be driven by more users buying more than 1 device (e.g. bike + tread)? In any case I think the decline is an ambiguous signal: e.g. more members per device can lead to faster depreciation which translates into demand for new hardware (hence a decline is negative); at the same time less members per device can mean that more people are buying their own devices instead of sharing them in a hotel or in a gym (hence a decline is positive).

Financials

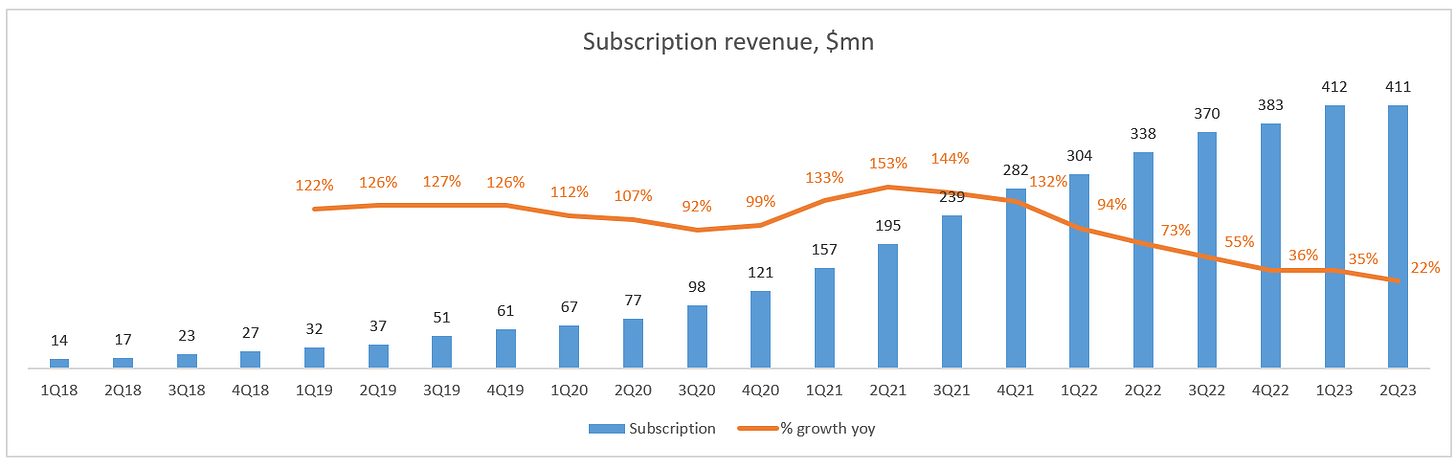

Year-on-year revenue dynamics still look disastrous at first glance, the speed of decline accelerated. The good part is that high margin subscription revenue remained above hardware revenue even in the high season, although flat subscription revenue versus the previous quarter is disturbing.

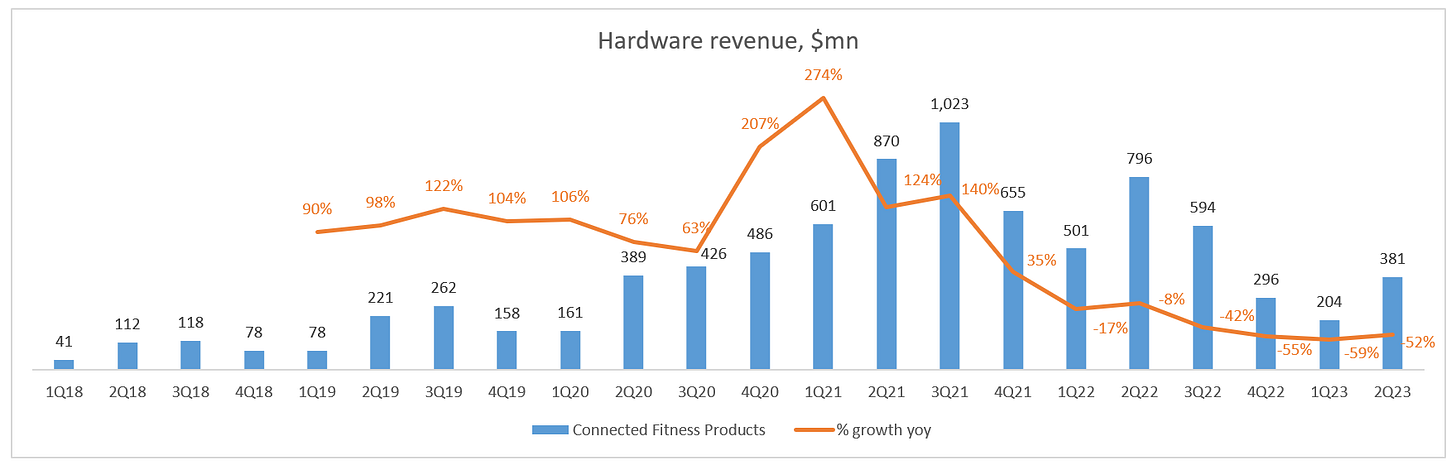

Year-on-year decline of hardware revenue continues to fluctuate around -50% on the back of a combination of factors such as post-covid cooldown of demand, aggressive discounting and using 3rd party retailers for distribution (which decreases net selling prices). I think we should be focusing not on hardware revenue per se, but on the number of net subscribers added because by the end of the day Peloton’s profit driver is subscription.

Subscription revenue looks much better, although growth has been moderating. A worrisome sign is almost flat quarter-on-quarter dynamics. My guess is that a part of December deliveries will transform into subscriptions only in January, but I’m not sure the effect is sizeable. Peloton will soon lap the 13% price increase introduced in June 2022 that supported revenue growth, so they will need to add more subscribers and probably to launch new tiers for app monetization in order to sustain SaaS revenue growth. Who knows, maybe they decide to increase the subscription price again: it may actually make sense if a combo of higher churn and higher price leads to higher profit.

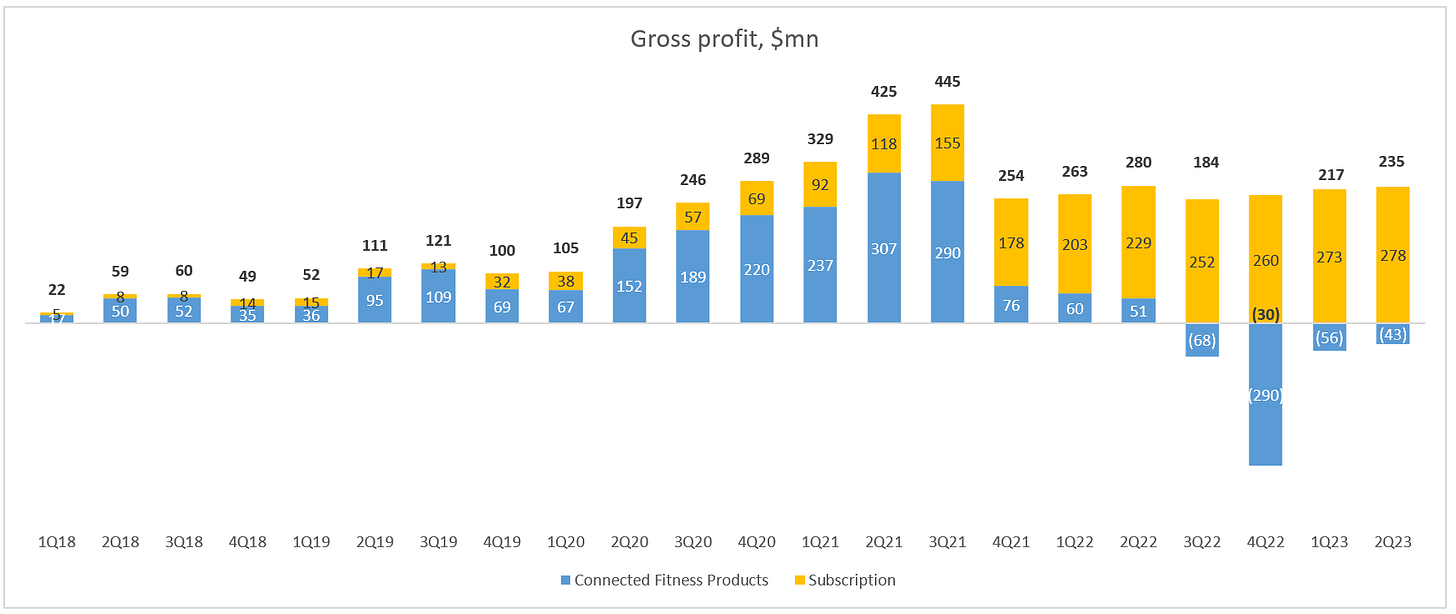

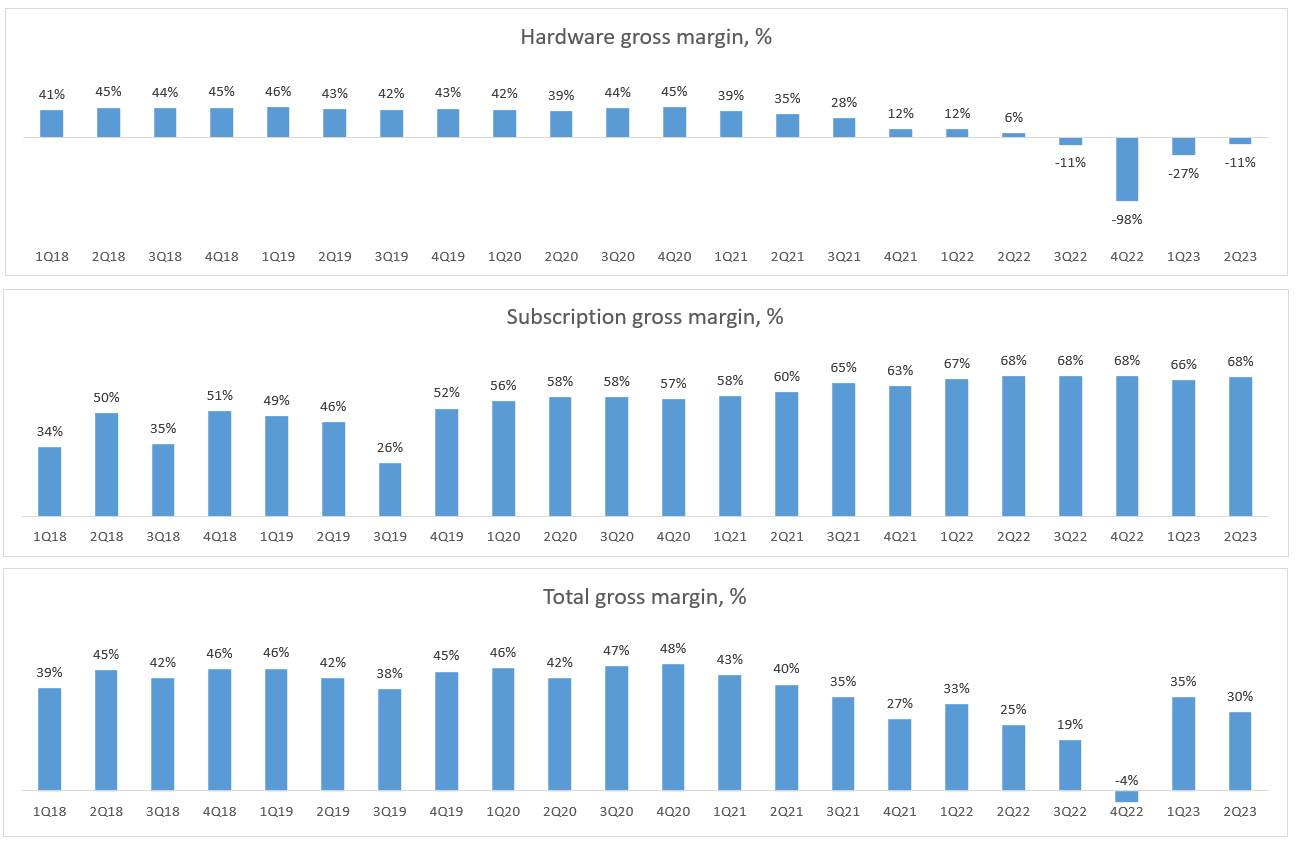

Gross margin fell significantly behind Peloton’s guidance for the quarter: 29.7% actual vs 36.0% guidance. The company cites higher share of hardware sales, lower hardware margin caused by discounts, higher COGS (mostly driven by excess and obsolete reserves related to Peloton Guide and returned bikes/treads that they no longer plan to refurbish; inventory related to shutdown of Tonic manufacturing facility).

According to management, $32mn of COGS is caused by hopefully one-off inventory reserves. So, if we remove them, hardware margin would be a more manageable -3% instead of -11%. But as usual you can never be sure that those “one-offs” don’t repeat.

Software margin remains steadily high at 67.6%. Contribution margin is even higher at 72.1%. I don’t have a complete history of contribution margin at hand, but I think it’s close to or at an all-time high.

According to CEO, they are targeting not margins for specific revenue lines, but overall LTV to CAC ratio. The LTV/CAC that he mentioned on the call looks very low to me at just 1.4x. I assume a large share of LTV is skewed towards the future because the annual churn is around 10%. So I don’t think they can achieve profitability even at a larger scale unless they manage to meaningfully improve unit economics.

Sales & marketing expense is down 38% (-$133mn) compared to the crazy spend one year ago. The decrease was driven by lower ad spend (-$107mn), salaries (-$13mn), retail expenses and other variables expenses. However, some of marketing expense was effectively substituted for lower gross margin via discounts to end users and retail distribution partners.

To put marketing expenses in perspective, the company still needs to spend $150-200mn per quarter just to compensate the churn and to keep the subscriber base more or less flat (subscribers are up 2% in the last 2 quarters). I understand that there are headwinds in the form of pressure on real disposable income, lockdown demand pull-forward and post-lockdown switching to gyms/outdoor fitness. But still the growth model doesn’t look viable at this point.

G&A expenses (-23% yoy) are becoming more reasonable, but are still too high for Peloton’s current scale as the CEO has acknowledged earlier (“G&A needs to come down as a percentage of revenue”). The decrease was driven mainly by professional fees (-$27mn) and personnel expenses (-$18mn).

An indirect indication of Peloton getting costs under control is the number of job openings - it is trailing down.

R&D expenses are also becoming more reasonable, down 20% versus last year. Cutting R&D is a dangerous zone because it can backfire later if the company finds itself behind competition in terms of technology. At the same time I don’t have a view on the right size of R&D expenses for Peloton, it just seems likely that during Foley’s reign they have been overspending on R&D as they have been on other operating expenses.

A separate noteworthy part of OPEX is SBC expense: to my mind it is still inadequately large at ~10% of revenue in the last quarter. I realize that the CEO needs to motivate and retain talent, but as a shareholder I would prefer a more gradual distribution of benefits to management, ideally skewed to the period after they actually succeed in turning the business around.

Cash flow dynamics are a bright spot at first glance. Management boasts positive free cash flow of $8mn if we exclude one-off compensations to suppliers to settle minimum purchase obligations. Sounds good, but if we are trying to gauge recurring FCF, we should also adjust for the inventory release ($200mn) which means that the company still burned ~$200mn in a seasonally strong quarter. With ~$950mn of cash and $500mn untapped credit facility this implies a runway of ~1.5 years - not critical, but very uncomfortable, especially given a potential hard landing of the economy.

Outlook for the next quarter looks modest in terms of subscribers and revenues, but pretty aggressive in terms of Gross Margin (39% vs 30% last quarter). I’m not sure how they are planning to achieve this, but maybe I’m underestimating the share of subscription revenue in a non-holiday quarter as well as one-off nature of some COGS associated with hardware revenue.

Strategic and operational updates

Barry McCarthy, Peloton’s new CEO has been with the company for 1 year (time flies!). Given the state of the business when he had been appointed, I think he has done a good job and is steering the company to the right direction. Barry named the following achievements (my comments in italics):

Rebuilt the executive team with five new hires, including a new CEO.

Inevitable move since the previous management team has discredited itself. Quality of the new management remains to be seen.Restructured operations, reducing employee headcount from 9k to nearly 4k.

Well done and importantly Peloton was ahead of many tech companies and non-tech covid beneficiaries when they initiated massive layoffs.Outsourced manufacturing of Connected Fitness Units (CFUs)

I think Peloton will be better off outsourcing production which implies less fixed costs and lower capital intensity.Outsourced last mile delivery and restructured customer support

Outsourcing non-core functions makes sense. Not sure what exactly they did with customer support though.Restructured Peloton’s apparel and accessories businesses

Launching apparel was a questionable move since it’s a low margin business, so maybe it should be shut down or outsourced. I don’t think Peloton has given out details of their plan with relation to apparel and accessories.

Raised $750 million in bank debt

This cushion definitely doesn’t hurt given cash burn and a relatively short runway.

Reduced gross inventory, excluding reserves, by $580 million from Q2FY22 to Q2FY23

Given the inventory glut, this was a must. It’s hard to assess efficiency, but at least inventory release has been generating the much needed cash in the last few quarters.

Reduced annualized run rate expenses from Q2FY22 to Q2FY23 by $830 million

One of the most impressive achievements. But we still need to see whether the new level of expenses is sustainable, especially in the context of the need for growth.

Resolved the CPSC investigation related to Tread+ and all major IP litigation matters with industry competitors

I’m not sure about the new team’s contribution here (the processes have been probably initiated some time ago), but it’s still good to have these out of the way.

Launched Row and Guide and related content

The company has been very reserved in comments about Guide, so the product looks like a flop to me. The impact of Row remains to be seen as the first batch was delivered only in December 2022. All we know is that its sales exceeded management’s expectations and 40-60% of row sales were to existing Peloton subscribers (doesn’t help valuable SaaS revenue, but probably reduces churn).

Launched Fitness as a Service (FaaS) and Peloton Certified Refurbished

FaaS model looks promising to me as it removes one of the main hurdles (high price of hardware). McCarthy mentioned that FaaS volume has doubled in the last quarter to 28k users and more than half of it was “incremental business”. But I’m not sure it can become a game changer because customers have already had an option of splitting the price into installments via BNPL (e.g. Peloton used to be Affirm’s largest customer).

Launched third party sales through Amazon and Dick’s Sporting Goods

Probably the right move as it moves part of costs from fixed to variable.

Restored and expanded live Studio classes in NY and London

I guess it helps brands awareness, but how efficient is this marketing channel?

McCarthy highlighted two changes to the previous plan:

Sale of greenfield manufacturing facility in Ohio was delayed for up to 6 months. Doesn’t sound like a big deal to me, provided that they actually close the sale within 6 months (if/when we face a recession, it will obviously be much harder to sell)

Peloton decided not to sell Precor (manufacturer of gym equipment that they bought during 2020-2021 spending frenzy) at this point because offered prices turned out to be well below Peloton’s fair value estimate. The new plan is to run Precor as a standalone business, increase its value and sell it later. The decision to keep the asset is questionable because there are hardly any meaningful synergies between Precor and Peloton’s core business. But at least they are not trying to integrate Precor and will run it as an independent business - I believe in benefits of decentralization.

He also outlined the following plans for the next year (my comments in italics):

Return to YOY revenue growth

Shouldn’t be that hard after they lap hard comps (after Q2 calendar year 2023). The question is if they can find the new growth engine to get back to double digit growth with reasonable CAC/LTV.

Reach sustained positive adjusted EBITDA

Although I’ve seen worse adjustments in “adjusted EBITDA”, it would still be better to focus on cash flows.

Reach sustained cash flow breakeven

This is the key short-term target as they remain at risk of running out of cash.Attract at least 1 million prospective Members to trial the Peloton App

I guess the target is achievable as they already have ~900k app users. I’m very curious what their app tiers will look like. Potentially this could become a meaningful source of high margin recurring.

Restore international growth

Conceptually yes, the question is whether they can quickly reach a large enough scale in each international location to justify fixed costs. Barry sounded like they don’t have a specific plan for international expansion yet.

Expand corporate wellness and other commercial partnerships

Conceptually makes sense too, although we hardly know anything about economics of such partnerships.

Continue reducing inventory

Would be nice to have a specific target for normal inventory level.

Continue restructuring retail store footprint

Hard to assess without details, but latest data suggests that they keep closing their retail locations. I think this makes sense as they have probably overspent on retail footprint by a wide margin.

Restructure middle mile warehouses and optimize last mile delivery network

Management acknowledges that they still have issues with last mile delivery, hopefully this helps to fix them.

Reach cash flow breakeven with Precor

Would be great if they can do it within a year and I hope it doesn’t require any significant capex.

Significantly improve Member support and the overall CFU delivery experience

According to management, customer services and last mile delivery are far from being perfect, I guess these are important for overall premium experience.

Sell Ohio manufacturing facility

Sure. I just hope they don’t have to put this on hold waiting for the next upturn in economic cycle.

McCarthy also commented on the priorities that he had set up in May 2022, a nice display of accountability:

Stabilizing our cash flow. Still planning to reach breakeven by June 2023. I think this will be hard to achieve - see the section on cash flows.

Getting the right leaders in the right roles. Peloton introduced 5 new top managers in the past year. The newest addition is Leslie Berland, a Chief Marketing Officer coming from Twitter where she shared two roles simultaneously: CMO and Head of People. I’m not sure about her personal contribution, but Twitter was terrible in terms of hiring. As Musk vividly demonstrated they had been overstaffed by at least 2x.

Reigniting growth. In 2022 the company focused on restructuring the business and stabilizing financial performance, I fully agree this should be the first priority. According to McCarthy, changes in product (good/better/best with Peloton App, refurbished bikes, bike rentals (fitness-as-a-service, FaaS) and premium priced units) and go to market strategy (Amazon, Dick’s Sporting Goods and Hilton partnerships) accounted for 19% of connected fitness units sold in the last quarter. He also named the launch of Row and Guide but without specific numbers. For now I think this box hasn’t been ticked and it remains the million dollar question: can they reignite profitable growth?

Valuation

The valuation task hasn’t become any easier since my previous write ups on Peloton. The spectrum of possible outcomes is still extremely wide: all the way from bankruptcy (or a buyout at a much lower valuation) to reigniting profitable growth and dominating the home fitness category.

I think any sophisticated methodology would likely result in illusion of precision as we don’t know where the business settles in terms of scale and margins. So I continue keeping it simple and using EV/Revenue multiples (0.5x for hardware and 5.0x for SaaS). A lot needs to change in order for Peloton to reach these projected financials and to deserve the SaaS multiple, but I think they do have reasonable chances to do it. This may sound banal, but a buy/sell decision depends on whether you believe that they will reignite their growth engine with reasonable LTV/CAC. As of the time of this writing I continue to hold my shares, but I’m on the fence: after the recent run up of share price (+90% YTD!) the upside to risk ratio is less attractive.

Finally, one crazy thought experiment for those who perceive Peloton stock at these levels as a call option. What would it take the stock to 10x from here ($15→$150)? Under my assumptions on multiples, they would need ~$15bn SaaS revenue which translates into ~25mn subscribers at current price of $44/month. For context, Netflix (where Barry McCarthy used to be a CFO) has 230mn users. Something tells me that it’s a bit easier to lure people into watching TV shows from the comfort of their sofas than sweating on a bike. Even 10mn Peloton subscribers is quite hard to imagine at this point. But Peloton’s BHAG is still 100mn, so who knows…

NB: I spotted an error in calculations in my previous piece, which led to underestimating hardware revenue. It didn’t have a material effect on valuation due to a low multiple applied to hardware revenue.